MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

The Year Volatility Returned

The lack of volatility in 2017 was nearly unprecedented. We witnessed 310 trading days without two consecutive daily pullbacks in the S&P 500 Index3 of at least 0.5%, according to research firm Bespoke Group.

The unprecedented streak ended in late January. History tells us we “revert to the mean (average).” Timing such events, however, is nearly impossible.

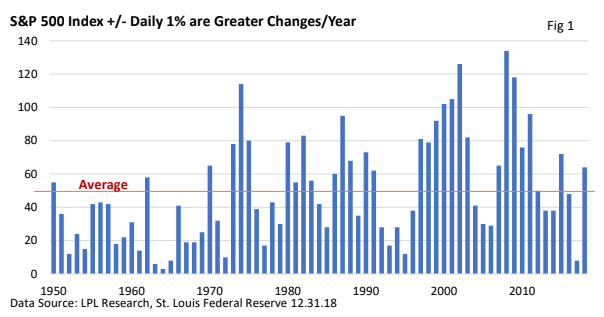

In 2018, the broad-based index of 500 major companies rose or fell by at least 1% 64 times versus just eight in 2017. Yet, as Figure 1 highlights, last year’s volatility was not out of the range of what might be considered unusual.

The modern S&P 500 Index began in 1957; prior data using S&P 90. Both are unmanaged and cannot be invested into directly.

Note in Figure 1 that 2007 – 2011 and 2015 produced a greater number of 1% daily changes. Still, the Q4 selloff exacerbated concerns.

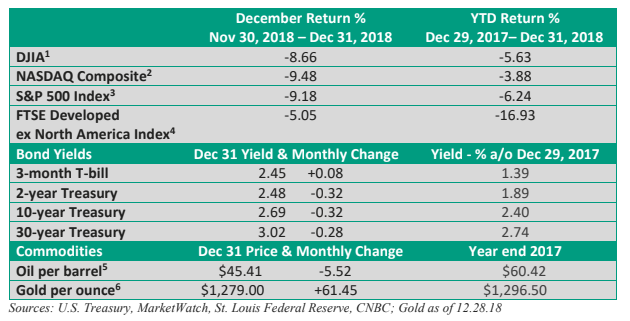

Figure 2 illustrates the late-year downturn, but it also highlights that year-end weakness was not out of the ordinary either.

Longer term, stocks react to the economic fundamentals. Short term, unpredictable events can quickly dampen sentiment, and pricing in uncertainty is difficult; hence, Q4’s decline and volatility.

What happened?

The global economy has been slowing and the US economy is showing signs of moderating. And with it, analysts have trimmed 2019 profit estimates (Refinitiv formerly Thomson Reuters). Consequently, some of the decline has been in reaction to the fundamentals. But was the selloff overdone?

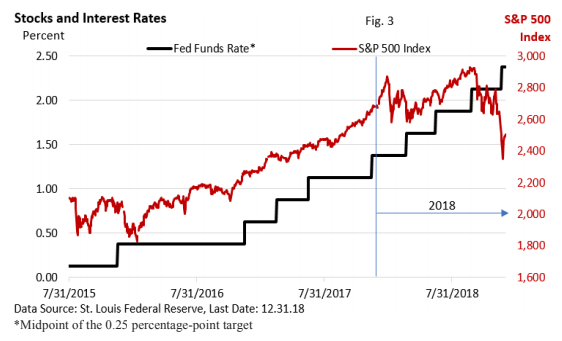

Eight rate hikes by the Federal Reserve since the rate-hike cycle began didn’t hamper bullish sentiment, that is, until October. Communication faux pas by Fed Chief Jerome Powell in early October and late December took a toll on sentiment.

While trade frictions between the U.S. and China added to the souring mood, the issue extends beyond its direct impact on stocks. For starters, there is a bipartisan consensus on Capitol Hill that China doesn’t play fairly. Furthermore, Chinese theft of intellectual property and forced technology transfers are creating national security issues.

While many in the US and around the world share the president’s goal of fair and free trade with China, the current path to obtain the desired outcome has generated some of the tensions we’ve seen in the market. This is not meant to be a political statement, only a reflection of the reality that stocks have traded down on negative trade headlines.

Looking ahead

- The economic outlook will likely influence the direction of markets over the next year. A strong holiday shopping season last year (Wall Street Journal) aids growth. Falling gasoline prices may lend additional support to consumer spending. But manufacturing appears to be slowing and US leading economic indicators suggest growth will moderate in the first half of 2019.

- Earnings growth peaked in 2018 and growth will slow in 2019. Markets have been trying to price in some of the slowdown; hence, some of the late-year decline can be traced to the fundamentals. But markets can overshoot on both the upside and downside.

- What will the Federal Reserve do? Eight rate hikes tied to economic growth did little to discourage investors until early October (Fig. 3) amid concerns that rate increases might stifle economic activity and depress corporate profits. Currently, the Fed has projected two 0.25 percentage point rate increases in 2019. The number of increases will likely depend on how the economy performs.

- The Trump administration delayed a big hike in tariffs on Chinese imports until March (WSJ), pending a trade deal with China. Plenty of ground must be covered over a short period of time. However, progress over the next couple of months and a workable framework might further delay the imposition of higher tariffs, which would likely aid business confidence.

- US political instability did little to slow stocks in 2017, as optimism about the economy fueled gains and overshadowed political worries. Today, turnover in the administration has injected uncertainty into the mix, though it’s difficult to quantify its impact. Will Congress and the administration work together or will acrimony continue?

- Brexit and Italy’s financial troubles aren’t far from the front burner. Both issues had a minor impact on trading this year. While the European Union has approved a deal for the UK to exit the EU, it’s an agreement that can’t pass Parliament. It’s been a difficult split, but it’s not in either party’s interests for the UK to fall out of the EU without an agreement that establishes parameters going forward.

Just the facts

The broad market indexes can be unpredictable, and selloffs can and do occur. While we have yet to break the 20% threshold that marks a bear market, the peak to trough for the S&P 500 came within 0.20 percentage points of bear territory. We saw similar drops in 1998 and 2011 without a corresponding recession.

Since WWII, the S&P 500 has averaged a pullback of 31% every 5 years. Since 1980, the annual average drawdown in the S&P 500 Index has been 14%. Yet, the index, including reinvested dividends, has risen nearly 80% of the time.

Despite regular pullbacks, the S&P 500 has produced a compounded annual return of nearly 10% since 1928, all dividends reinvested. That means a $100 investment 90 years ago was worth $382,370 at year end. The same investment in the 3-month T-bill would have turned into $2,052 and $7,366 for the 10-year Treasury bond (Data sources: NYU Stern School of Business Stock, Bond Returns, S&P Dow Jones Indices, LPL, St. Louis Federal Reserve; past performance no guarantee of future performance).

Selling low and buying high isn’t a way to reach your financial goals. It is one reason we recommend an evidenced-driven, highly diversified investment plan. It’s not only a roadmap to your goals, it reduces volatility and helps separate the emotional component that may encourage decisions based on the sentiment of the day. You know, when euphoria encourages too much risk, and pessimism pushes us to sell after a decline.

Following a diversified plan that incorporates factors outside of market sentiment has historically been the best path to reach one’s financial goals.

If you have any questions or concerns, feel free to reach out to me. That is what I’m here for.