MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

Fears Spread Faster Than the Coronavirus

For much of February, traders acted on the ebb and flow of coronavirus headlines. When the virus was contained to China, investors looked past most of the risk.

Sure, anxieties were surfacing that an economic slowdown in China could ripple across the globe, slowing U.S. exports and crimping supply chains. But headlines of the spreading virus didn’t prevent the S&P 500 Index3 from recording seven all-time closing highs last month (through Feb., 19, St. Louis Federal Reserve).

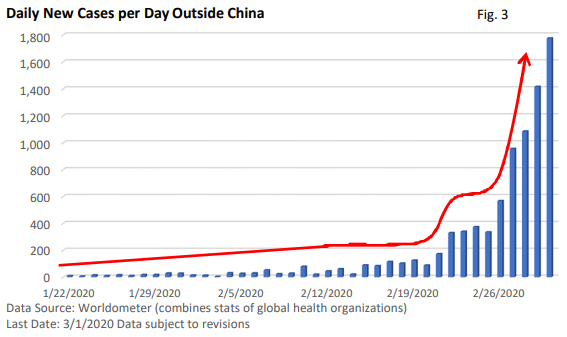

That is, until the weekend of Feb 22/23, when reports surfaced the coronavirus had spread to Italy, South Korea, and Iran. Cases in South Korea have exceeded 4,000 (as of March 1) followed by Italy at 1,704. Iran is just behind Italy, but most believe the country is dramatically underreporting the spread of the virus.

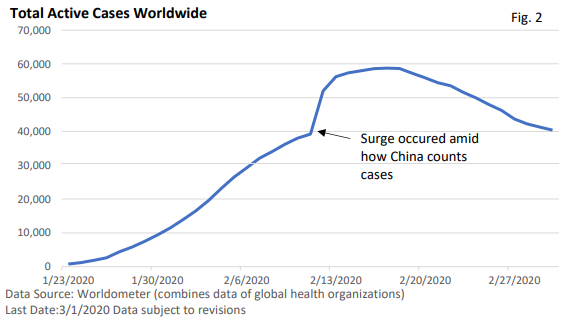

The epidemic in China appears to have plateaued, and new cases are declining. Since China has recorded the lion’s share of infections, the plateau in China is cautiously encouraging

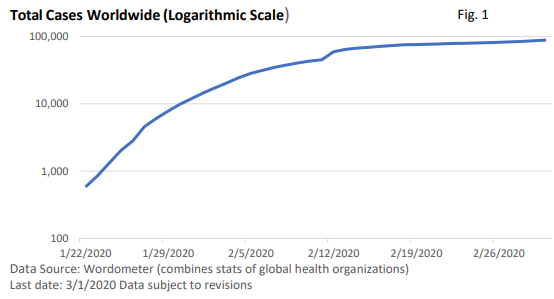

There are fewer than 100,000 cases worldwide and over eight billion people on the planet. Here’s another encouraging stat: the number of total active cases, which is total cases less recovered patients less those who have died, has been declining – see Figure 2.

What has spooked markets? The virus is no longer contained to China – see Figure 3.

Warranted or not, there are growing anxieties that the epidemic, which has yet to be officially declared a global pandemic by the World Health Organization, will hinder economic growth at home and abroad and potentially tip the economy into a recession.

Why? Consumers stay inside and cut back on spending, and businesses put projects on hold as they seek clarity.

From an investment perspective, investors do not like heightened uncertainty.

You see, in this case, heightened uncertainty simply means the number of economic outcomes has widened, and that widening is to the downside. Connecting the dots, slower economic growth hinders profit growth, which adds to volatility.

Adding to the more tumultuous market, stocks have surged since October and were priced for perfection. When shares are priced for perfection, they can be more vulnerable to a pullback that is triggered by an unexpected event.

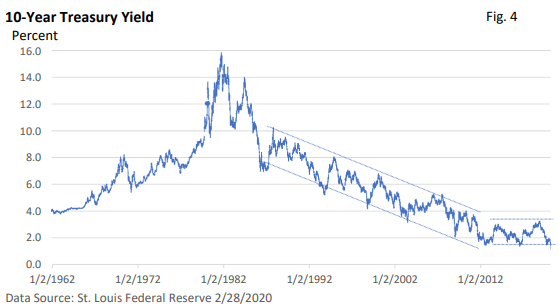

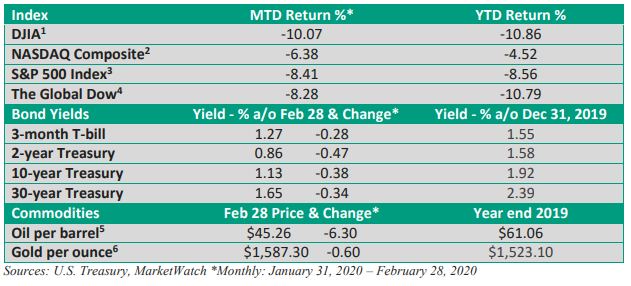

With the selloff in stocks, the 10-year Treasury yield (Figure 4) and the 30-year Treasury yield have fallen to all-time lows (Treasury bond prices and yields move in the opposite direction), as traders seek a safer haven in government bonds.

Perspective—pandemic of fear

The coronavirus is the latest in a series of events that have caused tremors in the stock market. We’ve seen pullbacks before, and we’ll see them again. Per CNBC, we’ve had 16 peak-to-trough declines in the S&P 500, ranging from 5% to nearly 20%, since the 2009 bull market began. February’s selloff is the latest.

What makes the coronavirus different from the flu or past epidemics? Great question and it’s one that’s hard to answer.

Could it be the 24-hour news cycle and its relentless coverage of the virus? Possibly. Or might the very cautious tone on Tuesday, February 25 from the Centers for Disease Control and Prevention (CDC) be creating needless worry?

I’m not a medical professional and don’t want to downplay the health impact. Eventually, we’ll be able to Monday morning quarterback media coverage.

What we do know is that the virus is contagious and can be transmitted from person to person. But so can the flu.

Per the CDC, 32 – 45 million people in the U.S. have contracted the flu (Oct 1 – Feb 22), 310,000 – 560,000 have been hospitalized, and tragically, 18,000 – 46,000 have died. But we incorporate the flu season into our daily routine, and news coverage of the flu pales in comparison to the coronavirus.

The 2009-10 H1N1 flu was classified as a pandemic. It was responsible for approximately 60.8 million cases, 274,304 hospitalizations, and 12,469 deaths in the United States per the CDC.

Yet, we didn’t get wall-to-wall coverage, and investors brushed aside most concerns.

Maybe the media were focused on a new president and the financial crisis and Great Recession. As we move into March, the number of cases in the U.S. will probably rise, but like China, I suspect growth in the virus will eventually slow and plateau. The timing, however, is uncertain. Meanwhile, health officials don’t expect the virus to mutate into something similar to the Spanish flu in 1918.

As I mentioned, I’m not a medical professional, but we should all take common sense precautions. Wash your hands, keep your hands away from your face, and use the sanitized towels for the grocery cart.

Simple safeguards will reduce the risk of contracting any number of viruses, including the cold or flu.

If you plan to travel, consider travel insurance.

Looking ahead

From an economic perspective, the Atlanta Fed’s GDPNow model is tracking Q1 GDP at a solid 2.6% (updated Feb 28). Job openings have come down (U.S. BLS), but the labor market continues to be tight, job growth has been strong (U.S. BLS), and weekly first-time claims for unemployment insurance are low (Dept of Labor).

On Friday Feb., 28, the Fed Chief Jerome Powell reiterated that fundamentals for the economy “remain strong.” But the Fed is “closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

That last sentence is the Fed’s way of hinting a rate cut or other action is likely in the pipeline. That said, an individually crafted financial plan that incorporates your goals and other factors, including your risk preferences and time horizon, has historically been the best path to achieve one’s financial goals.

The plan incorporates inevitable market declines and keeps one from making rash decisions when markets turn volatile. Or, for that matter, when stocks surge ahead, and one may be tempted to take a more aggressive but riskier posture.

I recognized that these are trying times, not simply from the vantage point of the investment community. No one likes uncertainty, especially as it relates to our health and the health of our loved ones.

Extreme uncertainty drains our most precious resource: our happiness. Turn off the news, get outside, and turn to what brings you peace. I am confident that this too shall eventually pass, and we will be better for it.

If you have any thoughts, questions, or concerns, feel free to reach out to me. That’s what I’m here for.