Dodging COVID and Global Troubles

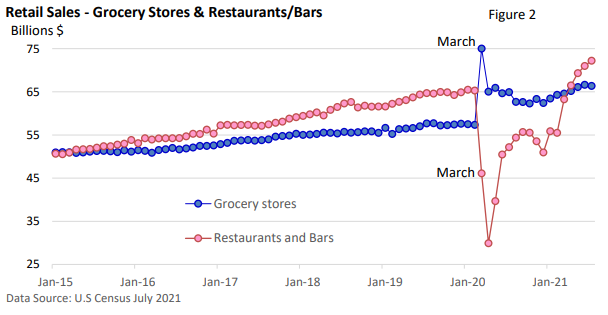

August is historically a weak month for stocks. Reviewing S&P data back to 1970, the average monthly return for the S&P 500 Index in August, excluding dividends, is just 0.21%. August ranks 11 out of 12. September is the worst month, with an average return of -0.65%.

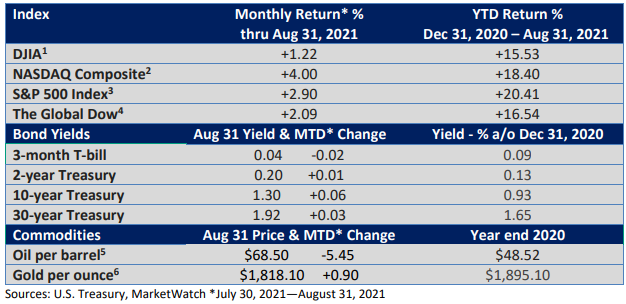

Yet, the table of returns illustrates investors overlooked troubling developments last month. Notably, the S&P 500 and the NASDAQ Composite notched several record highs in August. Both are sitting on sizable year-to-date gains. Why?

The same powerful tailwinds that have been in place for much of the year—economic growth, very strong profit growth, and very low interest rates—remain in place.

But, you may ask, “What about the rise in Covid cases?” So far, investors don’t believe the jump in Covid will have a material impact on U.S. economic growth. In past surges, local and state

governments restricted economic activity to curb the spread. Today, the market is viewing the vaccines as an inoculation against a rapid slowdown in the economy.

While the highly contagious Delta variant or any future variants could eventually disrupt activity, investors are not currently concerned about an economic impact.

You may also ask, “What about troubling news spewing out of Afghanistan?” The tragedy unfolding in Asia is disturbing. Investors, however, view the world through a very narrow lens: will the unrest in Afghanistan affect the U.S. economy?

Put another way, will the crisis deter people from traveling, delay a big purchase, or prevent someone from dining at a restaurant? The short answer: very doubtful.

We have seen hourly and day-to-day volatility, which is common during any bull market cycle. But investors don’t see an impact on U.S. economic growth over the next six to nine months from a Taliban takeover and possible civil war. By month’s end, major market indexes were just off all-time highs.

The economy, Covid, and stocks

Let’s review three broad-based indicators.

Weekly first-time claims for unemployment benefits measure the number of individuals each week who make their first-time application for benefits following a layoff.

When business activity is slowing, we’d expect layoffs to rise, as falling sales and falling profits encourage business owners to cut staff. Conversely, if business activity is picking up, we’d expect layoffs to decline, since most businesses would be more reluctant to lose employees.

Today, we have yet to see an upturn in layoffs (Figure 1), suggesting economic growth isn’t being significantly affected by the rise in Covid cases.

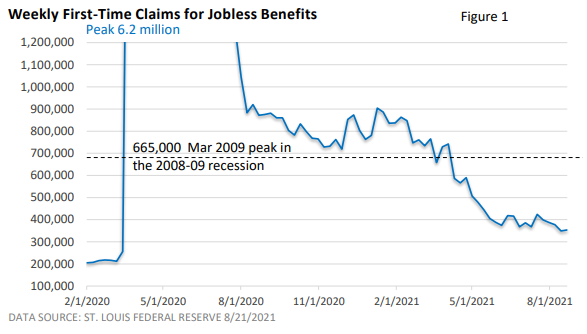

The second indicator offers a unique peek at how individuals and families view Covid.

Lockdowns and social distancing restrictions have had a big impact on restaurants and bars. Note the sharp decline in early 2020, when the pandemic began, and late 2020, when cases accelerated in the fall (Figure 2)

Through August, sales at restaurants and bars have gained ground for five-consecutive months, including a strong 1.7% rise in August. If people are concerned, they are not avoiding crowded restaurants.

Let’s briefly review one more report, the Leading Index from the Conference Board. The Leading Index consists of 10 economic indicators that tend to signal future economic activity.

The index rose a strong 0.9% in July, which follows a 0.5% rise in June and a 1.2% rise in May. July’s reading was a fresh all-time high, signaling that solid economic growth is expected to continue in the near term.

As we enter September, investors will consider whether lofty valuations can hold up to the unwinding of fiscal stimulus and the potential for a reduction in Federal Reserve bond buys later in the year. A pullback is inevitable. For now, powerful tailwinds have been supportive.