Last Year’s Stock Market Rally Extends into 2021

Last year’s stock market rally was an explosive recovery that saw the major market averages set new highs. We’re well into 2021, and the major market averages have continued to push to new heights.

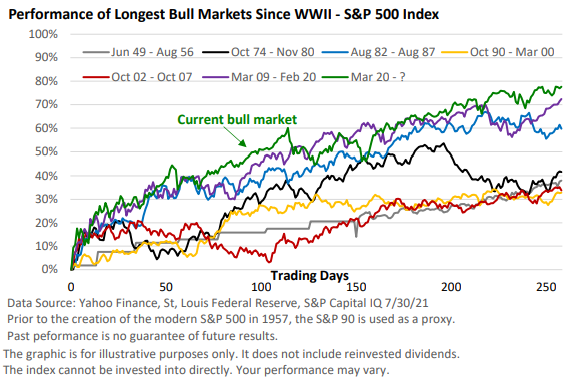

Figure 1 highlights the six longest running bull markets since WWII and compares them to the performance of the current bull run. Through the end of July, the current bull market, as measured by the broad-based S&P 500 Index3, takes the top spot. It exceeds the early performance of the long-running bull market that was born out of the 2008 financial crisis.

Before we get carried away and extrapolate today’s upward move, let’s also point out that the nearly 10-year bull market of the 1990s got off the ground slowly. In other words, let’s state something we already know, but bears repeating. Past performance is not a guarantee of future performance.

A review of the major themes driving stocks

If we step back and look at what is driving stocks, we can’t credit just one variable. Instead, several tailwinds have been responsible for the strong rally. These include:

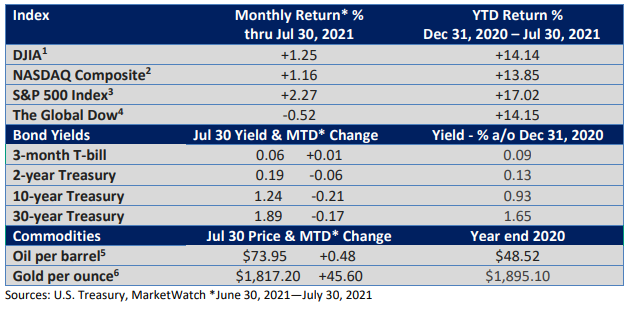

- The Fed has provided super easy money. Interest rates are extremely low, which encourages investors to seek out stocks for more acceptable returns. The Fed has also been buying about $120 billion in bonds each month, which pumps additional cash into the financial system

- The strong economic recovery has been a tailwind. It’s expensive, and it raises the federal deficit, but strong fiscal stimulus puts cash into the hands of consumers, which helps drive economic activity.

The U.S. BEA reported that Gross Domestic Product(GDP), the largest measure of goods and services, expanded at an annual pace of 6.5% in Q2, up from 6.3% in Q1. Consumer spending was an important component in the robust reports.

In addition, the vaccines have accelerated the reopening. Notably, spending in Q2 was strong for service-related businesses tied to activities outside the home.

- Plus, the strong economic recovery has led to huge gains in corporate profits, which have far exceeded analyst forecasts in recent quarters, according to Refinitiv.

As economic growth seems set to moderate in the third quarter, we’ll likely see profit growth moderate. However, analysts surveyed by Refinitiv continue to boost earnings forecasts in Q3 and Q4, which lends support to equities.

Looking at it as an equation, low interest rates + strong corporate profits tied to upbeat economic growth have led to a series of new highs in the major market indexes.

Yet, markets are never without risk. While there have been no major recent corrections, the risk we might see some type of pullback later in the year can’t be dismissed.

Economic growth is expected to continue this year, barring a sharp uptick in new Covid cases and related restrictions, which could create stock market volatility.

Inflation has been much higher than the Federal Reserve and many analysts had expected. If the surge in inflation isn’t temporary and proves to be more persistent than expected, we could see the Fed hit the monetary brakes faster than most anticipate.

For now, the Fed’s own projections released in June suggest the central bank may be penciling in two small rate hikes in 2023. Even if that occurs, rates would remain low by historical standards

Long-term perspective

Except for the 1987 stock market crash, bear markets (a 20% or greater decline in the S&P 500 Index), have been centered around recessions, according to S&P 500 data from the St. Louis Federal Reserve and Yahoo Finance. That streak has been in place since the mid-1960s.

Still, while long-term financial plans don’t eliminate risk, they help manage risk and take market volatility into account.

Following the big gains in stocks, it’s important to add that the investment plan is also designed to keep investors from taking on too much risk, when big market gains sometimes encourage individuals to dive too heavily into stocks.