Bond Reversal Powers November Advance

Many things influence the direction of stocks. Corporate profits, economic growth, general market sentiment, inflation, and interest rates are among those variables.

At any given point, the influence of various factors on stocks will fluctuate. In 2022, investors were predominantly concerned about the Fed’s efforts to combat inflation.

As the year began, the Fed slowed the pace of rate increases and a much-anticipated recession has been slow to materialize.

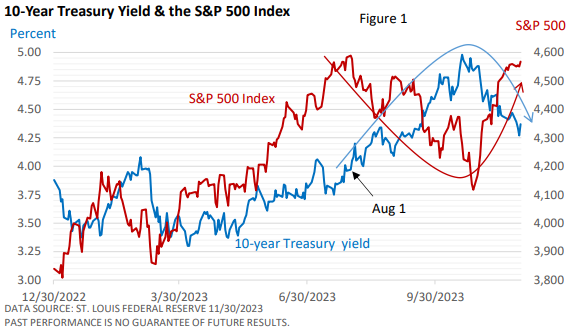

As August approached, the 10-year Treasury yield broke past 4%, creating challenges for investors. But Figure 1 isn’t simply about bonds. Since August there has been a steep inverse correlation between stocks and yields. Note that the yield peaked near the recent low (October 27th) for the S&P 500 Index.

Between August 1 and November 30, the correlation between the 10-year yield and the S&P 500 has been -0.79, where a correlation of +1.0 would mean the yield and the index move together and -1.0 would mean the yield and the index move in opposite directions.

For investors who hold a well-diversified portfolio of stocks and bonds, it has been a win-win since yields and bond prices move in the opposite direction.

The longer the term to maturity, the greater the upward or downward move in bond prices when yields fall or rise (all else equal). For example, given the same decline in the yield on the 2-year and the 10-year Treasury, we’d see a greater price appreciation in the 10-year bond.

Why have we seen a reversal in sentiment for bonds? After a strong third quarter for the economy, economic uncertainty is creating some interest in Treasury bonds.

A more cautious approach by the Federal Reserve is also playing a role. While the Federal Reserve has not shut the door on additional rate hikes, it’s looking increasingly like the Fed’s rate-hike campaign may be over.

At his November 1 press conference, Fed Chief Powell said the Fed is “proceeding carefully” four times, as policymakers aim to slow the rate of inflation without a significant rise in the jobless rate.

That’s a significant shift from a year ago when the Fed was aggressively raising interest rates.

Yet, the Fed doesn’t always get it right. It missed the surge in inflation and was forced to play catchup. Earlier this year, the Fed openly talked about a possible recession but has since removed it from its forecast.

Still, a good portion of its optimism is rooted in the slowdown in inflation.

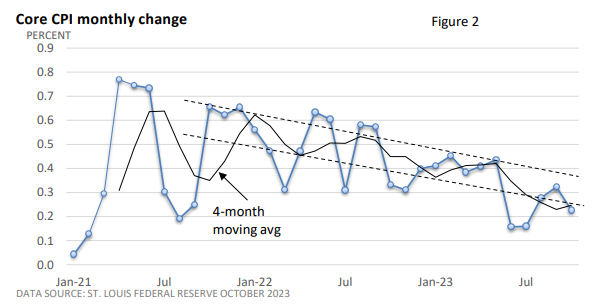

The core Consumer Price Index (CPI), which excludes food and energy, has gradually eased. Though it remains too high, we’re seeing progress amid a slowdown in the rate of inflation— see Figure 2.

But don’t expect prices to return to pre-pandemic levels.

Since January 2020, the CPI is up 19% through October 2023 (latest data available), according to the St. Louis Federal Reserve. The Fed’s stated goal is to slow the annual rate of inflation to 2%, not return prices to pre-pandemic levels.

As of October, the core CPI is running at 4.0% annually and the CPI is at 3.2% annually.

While consumers want lower prices, the bar for investors is lower—a continued slowdown in inflation. It gets trickier when you mix in milder economic growth without a recession, or at worst, a very mild recession.

Both would further cement the idea that the rate-hike cycle is over. But might we soon see a reduction in interest rates?

Investors have repeatedly front-run rate cuts that failed to materialize. However, milder inflation and slower economic growth would raise the odds of a cut in interest rates.