Stumbling Into a New Bull Market

Since the beginning of the year, the economy has displayed remarkable resilience in the face of rising interest rates, stubbornly high inflation, and turmoil in the banking sector.

We may be starting to see some cracks develop in the labor market, as layoffs are ticking higher.

But consumers are benefiting from lower gasoline prices compared to a year ago, and consumer confidence just hit its highest reading since the beginning of 2022, according to the Conference Board. Meanwhile, housing prices are inching higher again.

What about those never-ending recession forecasts? Most consumers and businesses haven’t gotten the memo, at least not yet.

As we’ve so often reminded you, economic forecasting is dicey at best, and it’s becoming even more problematic in the post-pandemic world.

This tongue-in-cheek comment included in June’s manufacturing survey from the Dallas Federal Reserve sums things up well.

“We continue to struggle to find qualified staff. We intend to hire more people … so that we have capacity available as soon as the economy starts to recover after the recession that everyone is predicting.”

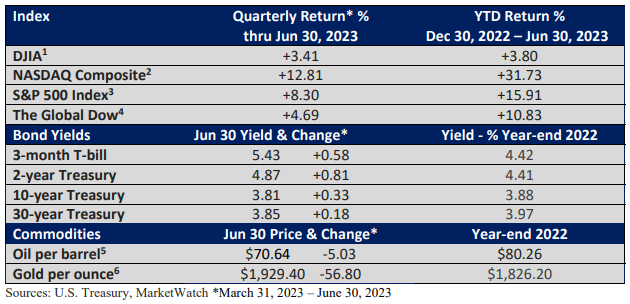

Maybe continued economic growth is simply a delayed response to last year’s sharp rise in interest rates. Or, if we take the opposing side of the recession argument, today’s 5% fed funds rate isn’t unusually high compared to historical standards, as illustrated in Figure 1.

This is especially true compared to today’s inflation rate of roughly 4-5%.

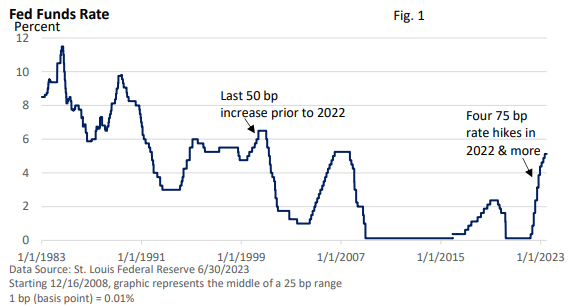

An important argument against an impending recession has been robust payroll growth.

Any standard definition of a recession would include job losses.

A recent Wall Street Journal article pointed out that a few economists believe the government’s survey is overstating payroll growth. But let’s assume it accurately reflects today’s labor market.

Why has payroll growth been so resilient? In part, it’s an expanding economy. But monthly numbers have averaged over 300,000 per month this year. That has surprised nearly everyone.

Another contributing factor is the abundance of job vacancies, making it easier in some industries to find work.

And some firms are hesitant to lay off employees when challenges surface amid the difficulty in finding qualified workers. Instead, they may opt to reduce work hours as a way to cut costs.

2022’s rally

The rise in the market was initially concentrated in tech stocks, but we saw a broadening of the rally in June.

Through June 30, it’s worth noting that the S&P 500 is up 24.4% from its low in October 2022, signifying the start of a new bull market (St. Louis Federal Reserve data). From a technical standpoint, a 20% rise from the most recent low marks the beginning of a bull market.

Another 7.8% rise in the index would vault it ahead of its record close in early 2022. It would be premature to wave the all-clear sign, as late 2001 and late 2008 experienced brief bull market rallies that faded, but this year’s gains are cautiously encouraging.

Although there is much uncertainty in both the U.S. and global economy, investors have not observed any concrete indications of an impending recession. Plus, the Federal Reserve has slowed the pace of rate hikes this year.

Both factors have been supportive of stocks.

A brave new world

One challenge for economists has been the ability to accurately predict shifts in unemployment and inflation. It has plagued economists for decades. Today, the situation gets more complex.

Currently, analysts are utilizing economic models that do not appear to fully consider all the economic distortions created by the shutdown and reopening of the economy, and an unprecedented injection of $5 trillion in fiscal stimulus.

It has disrupted conventional forecasting models. The combination of fiscal stimulus and the Fed’s strong response laid the foundation for a strong economic rebound. However, they also contributed to inflation, which was compounded by supply chain issues.

It’s a new challenge for the Fed, economists, and investors, especially short-term traders who bet on daily, weekly, or monthly market moves.

Timing has never been a surefire strategy. No one rings a bell at a market peak, and no one rings a bell when a bear market ends.

Market timers occasionally get lucky, but to be successful, one must consistently foresee highs and lows.

As 2022’s bear market came as a surprise to most, many timers failed to anticipate the turnaround this year against the backdrop of a hefty dose of negative sentiment.

That said, successful long-term investors recognize that a disciplined approach has historically been the shortest path to reaching one’s financial objectives.