Eyes on Bond Yields

The month of October has a reputation for significant stock market turbulence, such as the Crash of 1929 and 1987. The 2008 financial crisis also sparked a big selloff in October.

While trading on a daily basis can be volatile, the month historically finishes in the green.

On average, since 2010, October has been the second-best performing month for the S&P 500 Index per data from the St. Louis Federal Reserve.

Since 1970, October is tied for fourth place. That favorable trend, however, broke down this year.

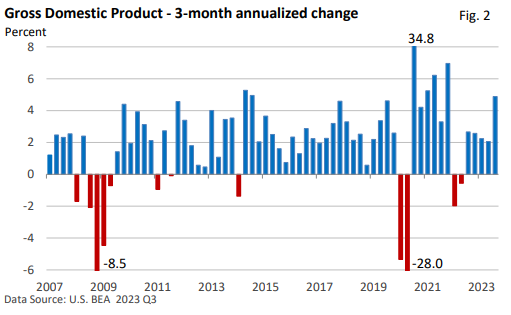

The main reason for last month’s setback was rising pressure on Treasury bond yields. In particular, the 10-year Treasury yield briefly reached 5%, the highest level since 2007 (CNBC).

It’s not that the Federal Reserve is threatening another extended series of rate hikes. But the Fed continues to insist that the fed funds rates will remain at a higher level for a longer period.

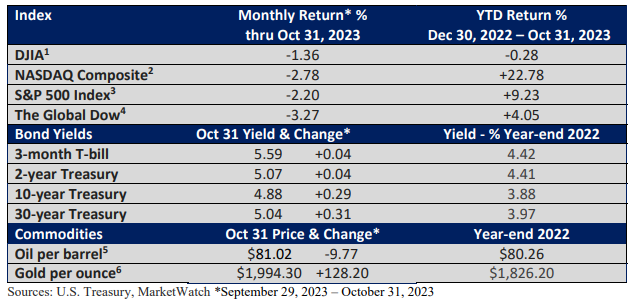

That is playing a role in the upward march of bond yields, as illustrated in Figure 1. Figure 1 plots the yield of Treasuries as of September 29 and October 31, with maturities ranging from one month to 30 years.

The Fed’s recent hesitation in lifting the Fed funds rate is keeping shorter-term yields in check. Its insistence that the fed funds rate will remain higher for longer, as it hopes to snuff out inflation, is one reason longer-term yields are rising.

Additionally, the rising federal deficit is forcing the Treasury Department to issue new bonds to finance the deficit, which is putting some pressure on yields, too.

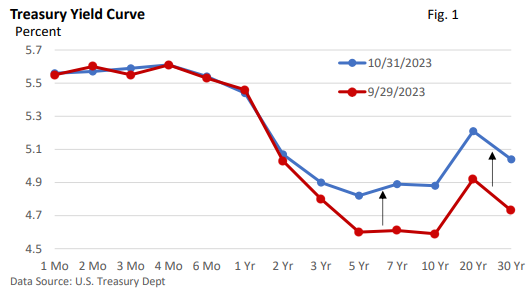

In addition, economic activity, which was expected to slow in Q3, accelerated sharply amid a spurt in consumer spending—see Figure 2.

Gross Domestic Product (GDP), the largest measure of the value of goods and services in the economy, expanded at an annual pace of 4.9% in Q3—see Figure 2.

It’s hard to pinpoint why the consumer suddenly came alive. It seems unlikely that Q3’s pace will continue, but a slowdown doesn’t necessarily mean weakness. Though they are barely keeping pace with inflation, wages are rising and firms continue to hire.

Rising wages and job growth support spending. Moreover, most analysts believe that some of the cash payments made to most folks during the pandemic remains in savings.

Geopolitical tremors

The world is a dangerous place. On October 7, Hamas, a designated terrorist group by the U.S. and European Union, launched an appalling and completely unwarranted attack on Israeli citizens and the nation of Israel.

Investors, however, focus on one thing. We recognize it may sound a little callous (and that is clearly not our intent, but we want to maintain a narrow focus and stick to what we know best), but the market attempts to put a price on any geopolitical event, i.e., its economic impact.

Thus far, outside of a brief rise in oil prices, there has been no discernible effect on the broader stock market. In fact, oil prices were down sharply in October—see table of market returns.

Why? For now, investors believe that the violence will be contained, which would limit the impact on the U.S. economy and oil.

Perhaps that is because past geopolitical shocks haven’t had much of a long-term impact.

While what happens in the past is no guarantee of future performance, reviewing 23 separate geopolitical events since Pearl Harbor, the average loss for the S&P 500 on the first day was 1.1%, with an average total pullback of 4.7% (simple return, excluding dividends reinvested), according to LPL Research.

The 1973 Yom Kippur War led to the OPEC oil embargo, soaring oil prices, and a steep U.S. recession, but it was an outlier. Today’s oil market is different, geopolitical dynamics in the Middle East are different, and the U.S. is a leading oil producer.

That said, any significant disruption in oil supplies would send the price of crude higher. Such an event can’t be completely discounted.

Final thoughts

Investors believe the war in the Middle East will remain contained to Israel and Hamas, having little impact on oil prices and the U.S. economy. So far, that has been the case.

Throughout the year, investors have closely monitored the economy and interest rates, as is typical. That’s not likely to change.

Typically, quarterly debt announcements from the Treasury go pretty much unnoticed, but not today.

The Treasury Department announced on October 30 that it will auction $776 billion in debt in the final three months of the year and expects to borrow another $816 billion in Q1 2024.

Much is simply rolling over of maturing bonds. But it highlights the enormous appetite for debt as the Treasury funds the growing federal deficit.

It is also putting upward pressure on bond yields. but it’s difficult to quantify the extent. Amid a moderation in the rate of inflation, rising bond yields are taking some of the pressure off the Fed to raise interest rates, but “higher for longer” is the current mindset among Fed officials.