Peeking Under the Hood of the Market’s Advance

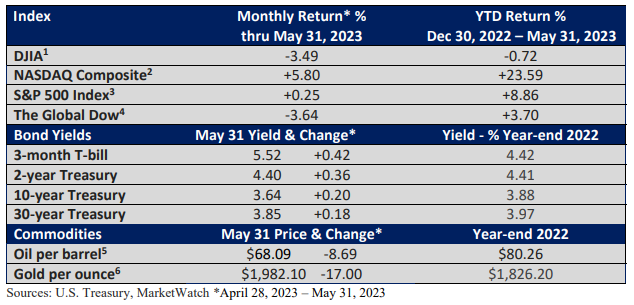

Market headlines are encouraging, at least on the surface. The tech-heavy Nasdaq Composite is having a stellar year and is up almost 24%. The S&P 500 Index is near its 2023 high and has gained almost 9% through the end of May.

The year 2022 presented significant challenges for technology stocks due to the sharp rise in interest rates last year. This is because fast-growing companies, like those in the tech industry, are typically more vulnerable to downturns when rates rise.

The gentler pace of rate hikes this year has aided the rebound in the Nasdaq. Additionally, the growing interest in artificial intelligence (AI) has also contributed to the success of some of these shares.

But a closer look reveals a less sanguine outlook. Note that the Dow, which is made up of 30 large firms, has lagged badly and is down slightly for the year.

The S&P 500 is a capitalization- (total number of shares multiplied by the stock price) weighted index, giving more weight to larger companies than smaller ones. Accordingly, outperformance among key larger firms is helping fuel gains in the overall index.

Near the end of May, Barron’s highlighted that the upbeat performance of the S&P 500 can be primarily attributed to the dominance of a few major tech stocks.

Upon further examination, it was discovered that only 26% of the S&P 500 firms had outperformed the index in the current year. It is the fewest number since March 2020, according to FactSet.

A cap on government debt

Last month, investors closely monitored discussions regarding the debt ceiling. A compromise was reached between the White House and House negotiators in late May. It sailed through the House on May 31 and moves to the Senate in front of a June 5 deadline, the earliest the debt ceiling might be breached.

If the U.S. were to default, it could lead to various negative outcomes, including unpaid bills, a potential credit downgrade, and severe consequences in both U.S. and global financial markets.

Such consequences could bring about economic instability, higher borrowing costs for the U.S. Treasury, a weaker dollar, and a possible loss of confidence in the U.S. government’s ability to manage its finances.

Please keep in mind that a default has never happened before, and the chances of it happening this time are slim. But if it were to occur, the variables are numerous, and the potential repercussions for the economy and financial markets could be severe.

General themes—interest rates, inflation, the Fed, the economy

It’s not all gloomy. While the rally has been uneven, it has been encouraging to see the S&P 500 Index rally off last year’s low in response to a more measured approach by the Federal Reserve.

The Fed hasn’t let up on its anti-inflation rhetoric, but recent comments from Fed officials, including Fed Chief Jay Powell, suggest the Fed could forgo a rate hike at the mid-June meeting. Ultimately, it may depend on the May CPI and May jobs report.

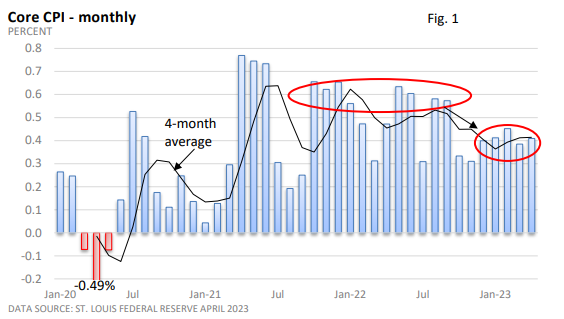

But is high inflation behind us? The short answer is ‘not yet.’ The core Consumer Price Index excludes two volatile categories: food and energy. Energy is down compared to one year ago. That’s good news, but it has masked a still stubbornly high rate of inflation.

As illustrated in Figure 1, inflation has decelerated from last year but has remained steady at around 0.4% over the past five months—stalled progress.

If annualized, that’s more than twice the Fed’s annual goal of 2%. The slowdown in inflation is uneven, just like everything else. Prices are always stickier going down than going up.

At present, the Fed is striving to maintain a delicate balance by curbing inflation while avoiding a severe economic downturn. The instability witnessed in a handful of regional banks has also contributed to its cautious approach.

A steep recession would probably seal the deal for the Fed on inflation, but the cost would be quite high, including a sharp rise in unemployment.

How does this play out for investors? For much of the year, investors have been weighing any favorable tailwinds from an eventual end to the rate-hike cycle with worries that the cumulative impact of rate hikes could lead to a recession later in the year.

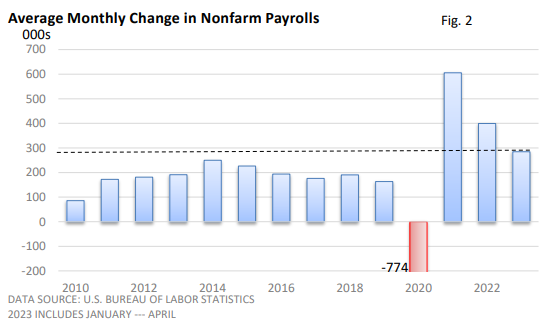

As May concludes, the economy is experiencing growth, the unemployment rate is low, the economy is adding jobs (Figure 2), and market trends suggest investors aren’t expecting a recession this year.

Why? The outlook is murky at best, but there aren’t yet any concrete signs that an economic contraction is imminent.