MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

Investors Balance Fundamentals and Fear

The series of new highs we experienced late last year carried over into 2020. During the first month of the year, the Dow Jones Industrial Average1 recorded 5-new closing highs, and the S&P 500 Index3 notched 6 new highs (St. Louis Federal Reserve data). The peak: January 17.

Furthermore, the S&P 500 Index failed to record two-consecutive daily losses for 29-straight trading days, tying a streak that goes back to 1955 (LPL Research, St. Louis Fed).

However, when stocks are priced for perfection, any kind of surprise can create volatility. After a strong run, fears a surprise epidemic in China—the coronavirus—could slow global economic growth provided the perfect backdrop for short-term traders to book profits.

Market drivers—the fundamentals

Many of the themes that fueled the market’s rise during the past decade have been present during the latest rally.

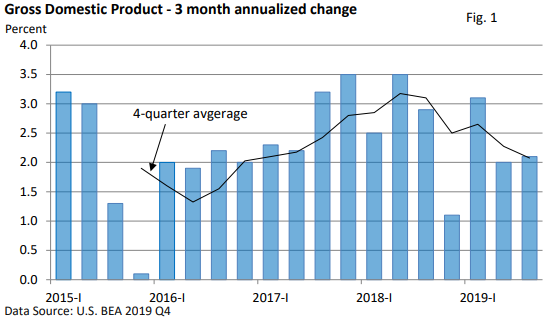

While growth has moderated, the U.S. economy continues to expand. During the final quarter of the year, Gross Domestic Product, which is the largest measure of the value of goods and services, expanded at a 2.1% annualized pace–see Figure 1.

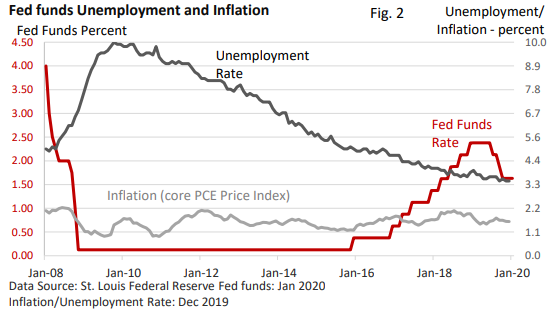

Interest rates remain very low and the Federal Reserve is once again expanding its balance sheet via T-bill purchases. Last year, the Fed cut rates three times (Figure 2), and the 10- year Treasury is yielding well below 2%.

With tailwinds being provided by economic growth, low-yielding, interest-bearing investments provide little competition for stocks. And with official measures of inflation below 2%, the Fed appears to be in no hurry to take back any of last year’s rate cuts.

According to Refinitiv, profit growth is forecast to accelerate in 2020 after being nearly flat in 2019.

The U.S. signed a limited trade deal with China, and Congress passed USMCA, which is a trade agreement between the U.S., Mexico, and Canada that replaces NAFTA.

Optimism is gradually rising that global growth may be stabilizing after slowing over the last two years. The coronavirus remains a wild card.

Priced for perfection

The latest upward leg in the long-running bull market is encouraging. But, when stocks surge and appear priced for perfection, any disappointments or surprises can leave shares vulnerable.

The coronavirus that originated in China has infected over 17,000 people, nearly all in China (MarketWatch as of Feb 2). Yet, we’ve seen epidemics hit the headlines before—SARS in 2003, the 2016 Zika virus, the 2009 H1N1 swine flu, and the 2014 Ebola outbreaks.

While we don’t know when or how quickly this virus may run its course, from an historical perspective, any damage to the global economy or markets was limited during prior epidemics.

Looking ahead

The Conference Board’s Leading Economic Index isn’t flashing red, but recent data suggest we may continue to see U.S. economic growth moderate in the first half of the year.

While trade tensions have diminished, President Trump has threatened to take action against European allies, which could create new uncertainty.

That said, conditions that typically lead to recession aren’t in place today, and low interest rates and an easy environment for accessing credit continue to support the U.S. economy. It’s an important reason stocks started on a positive note as the new year began. If you have any thoughts, questions, or concerns, feel free to reach out to me.