Seven Changes in Retirement Laws That May Affect You

Over three-quarters of Americans are anxious about their financial future, according to a Mind over Money survey by Capitol One and The Decision Lab.

Notably, 68% of survey respondents are worried about not having enough for retirement. Of course, it doesn’t have to be that way if we meet the problem head-on and hammer out a plan that helps you secure a comfortable retirement.

At the end of last year, Congress passed The SECURE Act 2.0, a follow-up to an overhaul of retirement laws passed just three years ago.

The changes build on SECURE 1.0, make it easier to save for retirement, and may help stretch out your savings while in retirement.

Let’s look at some major provisions that will help workers, followed by changes that may assist those who have left the workforce.

- Starting in 2025, companies that set up new 401(k) or 403(b) plans will be required to automatically enroll employees at a rate between 3—10% of their salary.

Employees may choose to opt out, but we believe that saving for retirement is nonnegotiable. The new law also makes it easier to transfer low-balance plans to new ones. - If you are enrolled in a Roth 401(k), you won’t be required to take what’s called a Required Minimum Distribution (RMD) from your Roth 401(k). That begins in 2024.

- Starting next year, employers will be allowed to match student loan payments made by their employees. The employer’s match must be placed in a retirement account.

This doesn’t benefit everyone, and we understand the controversy that surrounds student loan debt forgiveness. But if your employer offers this benefit, it’s a great way to capture free money for retirement. - In 2025, 2.0 increases the catchup IRA provision for those between 60 and 63, from $6,500 in 2022 ($7,500 in 2023 if 50 or older) to $10,000. The amount is indexed to inflation. Catchup dollars are required to be made into a Roth IRA unless wages are under $145,000.

- Starting in 2024 and subject to annual Roth contribution limits, assets in a 529 college savings plan may be rolled into a Roth IRA, with a maximum lifetime limit of $35,000. The 529 plan must be at least 15 years old and in the beneficiary’s name.

What if you are already retired?

- A key provision raises the age for an RMD to 73 years old from 72, starting in 2023. The age rises to 75 in 2033.

If you turned 72 in 2022, you’ll stick with the previous timetable. If you turn 72 this year, you may delay your RMD until 2024, when you turn 73. Starting in 2033, the age for an RMD rises to 75. Generally, the longer you can shelter assets from taxes, the better.

- Additionally, the penalty for failing to take your RMD from a retirement account that requires such a distribution drops to 25% from 50%.

If the missed RMD is taken in a timely manner and an updated tax return is filed, the penalty is reduced to 10%.

This is not all-inclusive. There are provisions that allow for hardship withdrawals, charitable contributions, withdrawals tied to domestic violence, and federally declared natural disasters. We encourage you to check in with your tax advisor if you have any tax-related questions.

We are also happy to entertain any questions you may have, including planning questions that will help you take advantage of the new law.

Sources: Fidelity, Charles Schwab, Think Advisor, Wall Street Journal

Running through the numbers—cautious optimism as the year begins

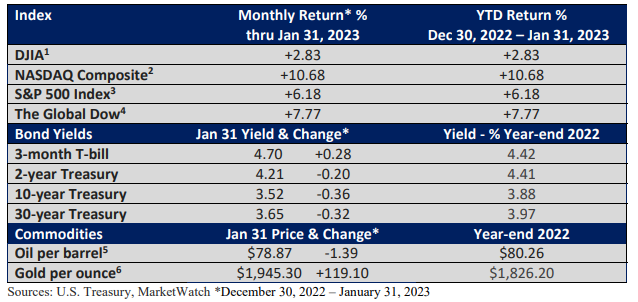

When January is positive, the S&P 500 Index has gone on to end the year higher 75% of the time, according to Fidelity (since 1945). The S&P 500 advanced 6.18% in January—see table of returns below.

Perhaps the proclivity of the market to move higher plays a big role. Besides, simply starting out well in January gives one a head start on the rest of the year.

From 1970 through 2021, the S&P 500 Index exceeded a 5% gain in January 10 times (St. Louis Federal Reserve data). Excluding reinvested dividends, it went on to finish the year higher 9 times.

During the 10 years when January advanced by 5% or more, the S&P 500 averaged a return of 21.5%. Its best annual return was 31.6% in 1975, after exiting the difficult 1973-74 bear market. Its weakest return was a decline of 6.2% in 2018.

Such exercises are interesting, but every cycle has its own peculiarities. We know that past performance does not guarantee future results. Ultimately, the economic fundamentals will play a big role as the year unfolds.

While there has been no shortage of recession talk, market performance in January suggested that investors don’t believe a recession will materialize in the early part of the year.

In addition, heavy bearish sentiment sometimes sets the stage for a market bounce, as we saw at the beginning of the year.

More importantly, the Federal Reserve is signaling a slowdown in the pace of rate hikes, which aided January’s advance. Investors also expect at least one rate cut this year. That may have added to gains, but it is something the Fed has pushed back on.

A quick note of caution is in order. Fed rate forecasts in early 2022 were way off the mark.

However, it would be favorable if the economy avoids a recession, the rate of inflation continues to slow, and the Fed stops raising interest rates.