MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

A Rising Stock Market, Housing’s Doldrums, and Animal Spirits

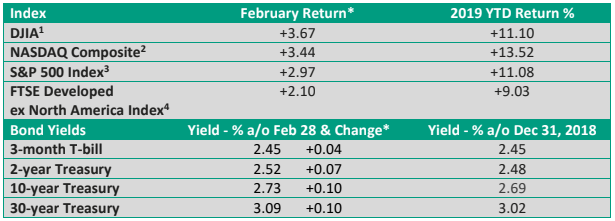

It’s been a strong start to 2019. In researching this month’s piece, I came across these stats that illustrate market strength.

Through Friday, February 24 —

- The Dow Jones Industrial Average and the S&P 500 Index are off to their best starts in over 30 years, according to Dow Jones Market Data (MarketWatch).

- We’ve had 8-straight weekly gains for the Dow in 2019, which is the best start since 1964 when the granddaddy of market averages logged 11-weekly gains.

- The Russell 2000 Index^ has rung up its longest-ever weekly win streak to start a year – 8 in a row.

^The Russell 2000 Index is an unmanaged index of 2,000 smaller companies. The index cannot be invested into directly. Past performance does not guarantee future performance.

What’s behind the rally?

In part, the market was extremely oversold in late December, and markets tend to eventually bounce when the economic fundamentals don’t line up with a significant selloff.

But the snapback from oversold levels doesn’t completely explain recent gains.

- For starters, the Fed’s new-found flexibility is aiding shares. No longer are investors worried the Fed might push rates up too high and kill the economic expansion. Instead, the Fed said it can be patient as it eyes any changes in interest rates. While the Fed hasn’t defined exactly what it means by “patient,” broadly speaking, it means the Fed isn’t planning any near-term rate increases.

Though sentiment can shift quickly, one measure of rate expectations published by the CME Group places odds the Fed won’t raise the fed funds rate this year at 90% (as of Feb 28).

- Continued progress on the trade front with China has also lifted spirits. And there have been no

shortage of encouraging headlines.One from Reuters on February 20: Exclusive: U.S., China sketch outlines of deal to end trade war – sources. These included: forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture, and non-tariff barriers to trade, according to two sources familiar with the progress of the talks.

As the month continued to progress, President Trump postponed a sharp increase in tariffs on Chinese imports, which had been scheduled for March 2. Still, sticking points remain. Reduced barriers to U.S. exports would be welcome. However, enforcement provisions that relate to forced technology transfers and structural changes that cut subsidies for state-owned businesses must be hammered out.

The abrupt end to the U.S./North Korean summit adds an interesting wrinkle. Did China play a role in the failed talks. Or was Trump’s decision to walk out a signal to China that he could do the same on a trade agreement if it wasn’t to his liking? Early market reaction suggests it is not an issue.

- Though economic data have been mixed, the U.S economy continues to expand, albeit at more moderate pace. Note that GDP slowed from 3.4% in Q3 to 2.6% in Q4 (U.S. BEA). The path for housing and consumer attitudes is indicative of the mixed reports.

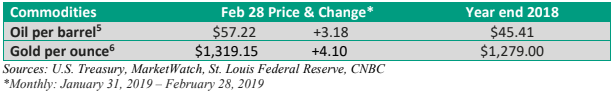

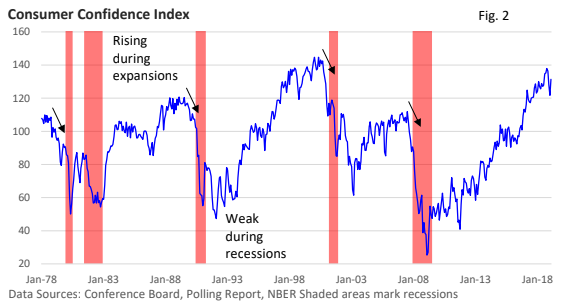

Housings shaky foundation

Housing has been in the doldrums. Prices have been rising for several years, inventory has been limited, especially for starter homes, and mortgage rates spiked last year.

Sifting through the data tells us that this leading economic indicator has fallen into a recession. Existing home sales and new home sales are down (Natl Assoc. of Realtor [NAR] and U.S Census Bureau). And the same can be said for housing starts and building permits – see Figure 1.

Single-family housing starts are clearly more volatile, but the trend has been to the downside. Permits, which are more forward-looking, have also floundered.

Lately, however, we may be seeing some stability amid the decline in mortgage rates (Freddie Mac weekly survey). Homebuilder confidence has improved per the NAHB monthly survey, and January’s NAR’s index of pending home sales rose at its fastest monthly pace since early 2017.

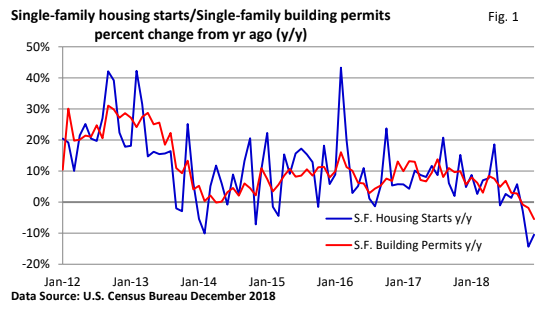

Animal Spirits

Mixed data is another way of saying that some reports are strong while others are weak. So, let’s end this update on a more favorable note. After sliding three-consecutive months, consumer confidence surged in February.

The end of the government shutdown and rising stock prices appeared to bolster sentiment.

This is a soft measure of the economy as sentiment isn’t a direct component of GDP. But it is a gauge that measures the “animal spirits” that can drive economic activity. A low level of confidence suggests animal spirits are dormant, while a high level suggests they are stirring.

While the level matters, the trend is just as important. Note in Figure 2 that confidence typically peaks in front of a recession, which makes February’s sharp gain encouraging as we push into 2019.