Investors Fret Over Faster Economic Growth

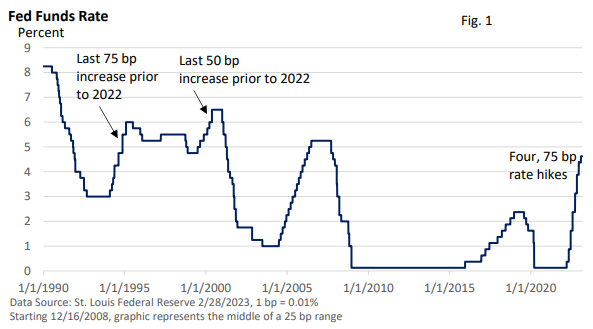

The year started on a positive note as investors attempted to price in a sharp slowdown in rate hikes and a near-term peak in the fed funds rate. While a peak in rates this month was probably too optimistic, the Fed followed the rate-hike script, boosting the fed funds rate in early February by 25 basis points (bp, 1 bp = 0.01%) to 4.50—4.75%.

But economic activity diverged from the script.

Shortly after the Fed’s rate increase, the U.S. BLS reported that January nonfarm payrolls exploded, rising over 500,000.

In part, there are so many job openings to fill. Despite high-profile announcements among some firms, layoffs remain low, and some of the job creation is simply the byproduct of economic growth.

In addition, consumer spending, which accounts for about 70% of economic activity, surged in January, easily offsetting weakness in November and December (U.S. BEA data).

While inflation slowed late last year, revisions to the data reveal it didn’t soften as much as initially reported. Moreover, January’s inflation data came in hotter than expected.

The road to price stability wasn’t going to be a straight line, but upward revisions were a disappointment.

What does this all mean? Sentiment on the rate front quickly shifted last month, and investors now believe a more aggressive response by the Fed could be forthcoming.

It’s not market-friendly, as February gave back some of January’s advance.

No landing

Soft or hard landing scenarios have dominated financial market headlines. The narrow path to a soft economic landing simply means an economic slowdown that brings about a much slower rate of inflation without a recession. It’s the best path for investors.

According to the Fed’s rationale, much slower economic growth allows the supply of goods, services, and labor to match demand, which reduces pricing power and inflation.

As the term implies, a hard economic landing would be defined as a recession that significantly raises the unemployment rate. Inflation would likely slow, but the cost would be high.

While January’s data is just that, a one-month data point, economic vigor encouraged analysts to coin a new term: ‘no landing.’ In other words, the economy continues to expand through 2023, and inflation doesn’t slow much from its current pace.

What is the thinking behind no landing? Well, cost-of-living pay increases and a just-enacted rise in Social Security payments are boosting income and spending.

In addition, plenty of stimulus cash from generous cash payments during the pandemic still resides in savings. Such savings can still fuel spending, too.

While spending on goods has gradually slowed, spending on services, which is the largest sector of the economy, is trending higher. It’s a shift away from spending on “stuff” to spending on entertainment, travel, and experiences.

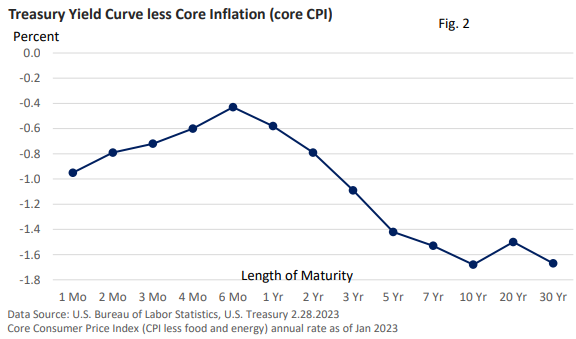

Despite sharp rate increases, interest rates adjusted for inflation are still negative across the yield curve.

Figure 2 plots Treasury yields by maturity (1 month to 30 years) and subtracts the January rate of 5.6% for the core Consumer Price Index (CPI less food and energy). If the headline CPI was used, the yield would be almost one-percentage point lower.

This is important because low yields and lower interest rates relative to inflation may encourage borrowing and spending because the interest rate adjusted for inflation is nominal or negative.

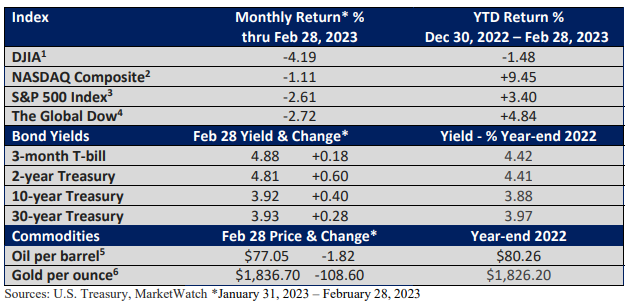

Note in the table of stock and bond returns that bond yields rose last month in response to recently revised rate-hike expectations. Higher rates compete for investor dollars, which can create added headwinds for stocks.

Sentiment can change quickly, as we saw last month. Perhaps we will be having a different conversation later in the year, as economic growth is typically uneven.

For now, last month’s economic acceleration was viewed negatively by investors, who have grown weary of high inflation and upward pressure on interest rates.