As January Goes, So Goes the Year… or Does It?

The January Barometer is a tool that attempts to predict the annual market performance based on how an index performs in January. For example, the S&P 500 Index returned 6.2% in January 2023. For the year, the S&P 500 Index advanced 24.2% (Note: data on S&P 500 returns exclude reinvested dividends. Data gathered from the St. Louis Federal Reserve).

Last year was a ringing endorsement for the January barometer. But was 2023 an exception? Let’s dive in and take a look.

Since 1970, the S&P 500 in January advanced 57% of the time. On the flip side, January was down 43% of the time. The broad-based S&P 500 finished the year in the green 75% of the time. That doesn’t tell us much, so let’s dig deeper.

When the S&P 500 was positive in January, the index finished the year higher 87% of the time. Last month, the S&P 500 advanced 1.59%.

When January ends in the red, it doesn’t necessarily mean the S&P 500 will end the year lower. Historically, the S&P 500 registered an annual loss 43% of the time.

The verdict

Is there really something to the January barometer? Well, the best answer is probably yes and no.

Yes, perhaps because the market has a propensity to rise over time. So, a positive start to the year and an upward bias suggest that prospects are favorable.

Additionally, a positive start could be viewed as a head start. ‘Team S&P 500’ takes an early lead, and the bears are at a disadvantage heading into the rest of the year.

Even when January finishes lower, the odds still favor a positive finish. But with ‘Team Bear’ taking an early lead, the bulls are forced to overcome an early deficit, and the odds of a winning year are lower.

No, because what is happening to stocks in January may have little bearing later in the year. Bottom line—the January Barometer has historically favored a positive year when the market starts strong. Nonetheless, a negative start doesn’t necessarily signal a weak year.

Yet, please be mindful that past performance does not guarantee what will happen in the future, including 2024. Historically, the economic fundamentals influence market performance over a longer period.

In 2022, soaring interest rates and high inflation tipped the balance in favor of bearish sentiment. In 2023, stocks turned higher as the Fed significantly slowed the pace of rate hikes, inflation slowed, and the economy avoided a profit-killing recession.

A respectable start & a new high

Optimism Abounds… This New Year, the Wall Street Journal said on January 1. November and December treated investors quite well, and sentiment was extremely favorable.

Yet, the year started with a modest degree of uncertainty. It’s not that we saw a big pullback. On the contrary, the dip was very modest. It may have simply been tied to investors who decided to take profits in tax year 2024 rather than in December.

But optimism about the economy and interest rates helped the S&P 500 Index reach new highs in January, surpassing the previous high set two years ago.

Today, the Federal Reserve is openly talking about cutting rates. How many reductions, assuming they take place, is unclear. But in December, the Fed’s own Summary of Economic Projections indicated three quarter-point rate cuts in 2024.

On January 31, Fed Chief Jay Powell tamped down on enthusiasm for a March rate cut, which encouraged a selloff on the last day of the month. But a May or June rate cut can’t be ruled out.

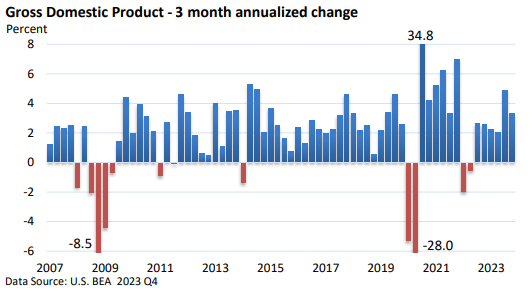

More importantly, the economy continues to expand at a moderate pace. While backward-looking (October – December), Gross Domestic Product (GDP), which is the largest measure of economic activity, expanded at a solid clip, up at an annual pace of 3.3% in Q4

Faster economic growth reduces the odds of Fed rate cuts as there is less pressure for the Fed to stimulate economic activity.

As Powell framed it, barring an unexpected slowdown in the economy, the timing of rate cuts will be linked to how quickly inflation is returning to the Fed’s annual goal of 2%. Put another way, the debate is now centered around ‘when’ not ‘if’ on interest rates.

Still, economic growth supports corporate earnings, albeit unevenly. While investors may not see an aggressive rate-cutting cycle in 2024 (much will depend on the economy), a reduction in interest rates, coupled with modest economic growth, has historically been supportive of stocks.

Please let me know if you have questions or would like to discuss any other matters.