MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

A Bright Start to the New Year

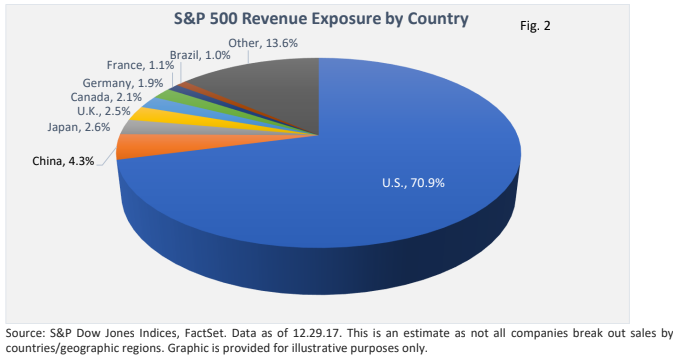

Stocks took a beating late last year, with key market indexes putting in their 2018 lows the day before Christmas (WSJ, various sources). For daily-market watchers – something that’s not recommended for longer-term investors – volatility and quick shifts in sentiment can be maddening. Besides, over a shorter period, markets can overshoot and can undershoot.

Since Christmas Eve, major U.S. market indexes have stabilized and posted strong gains. What’s behind the upturn in sentiment? Let’s review some of the factors behind the rally.

- Fed Chairman Jerome Powell is doing a better job of conveying the Federal Reserve’s intentions.

Many variables flow into the stock market price equation, including interest rates and the expected direction of interest rates. In December, the Fed projected two rate increases in 2019 (down from four in 2018), and Powell highlighted the strength of the economy.

However, investors took his upbeat remarks as a sign the Fed might hike rates too high and prematurely end the economic expansion.

Enter January and Powell emphasized a different message. He said the Fed will be flexible going forward, carefully reviewing market signals and the economic data as it considers any rate increases.

The Fed took an even more dovish turn at its end-of January meeting, eliminating language in its post-meeting statement that “gradual” rate hikes might be needed. Instead, the Fed said it could be “patient” on raising rates, which likely means no increases at least through June, and maybe through much of the year. It all depends on the economy.

- Trade frictions and acrimony with China took a toll on stocks last year. This year, cautiously optimistic headlines that some progress is being made on a new deal has lifted spirits. That said, the U.S. and China have plenty of ground to cover, and we may see short-term risks may pop up again.

Still, both sides have a vested interest in reaching an agreement. China’s economy is slowing down, and new barriers will take a deeper bite. Failed talks may create a new cloud over U.S. growth and could create additional short-term market volatility.

- An early read on Q4 S&P 500 earnings haven’t been that bad. Definitive estimates (through 1/31/19) Q4 earnings will rise 15.0% vs a year ago. It’s down from Q3’s 28.4%, but commentary being issued has been respectable.

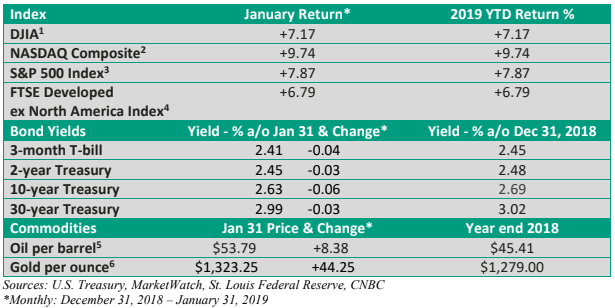

Looking ahead, profit growth is projected to slow significantly in 2019 – see Figure 1. In part, 2018 was aided by a big cut in the corporate tax rate, so a slowdown was expected. Given some of the uncertainty over the U.S. and global economy, analysts have been ratcheting down 2019 estimates. Still, current forecasts are reasonable.

- Strong employment numbers from the U.S. BLS in December and January have alleviated fears that economic growth might be poised to slow too quickly.

- Oil prices have stabilized. A continue drop in oil prices might be welcome for drivers, but it could also be a sign world demand is faltering. Such a scenario might signal a recession.

Does global growth matter? The short answer – sort of

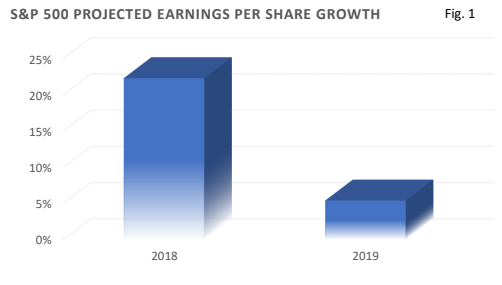

U.S. exports account for about 13% of total U.S. economic activity (U.S. BEA data), and S&P 500 companies gather an estimated 30% of sales from overseas (exports are products made at home and sold overseas; overseas sales may or may not have originated in the U.S.).

When global growth slows, sales from the larger multinationals may feel some of the pain. In January, Apple (AAPL $166) and Caterpillar (CAT $133) warned that weakness in China was pressuring sales. And the major stock market indexes reacted negatively on those days.

We sometimes experience volatility when bellwethers report unexpectedly bad news (the opposite can be true, too), but as Figure 2 illustrates, China does not account for a significant share of corporate revenues. U.S. exports to China make up about 1% of U.S. economic activity (U.S. BEA data).

The S&P 500’s advance last month was the best January in over 30 years, per the Wall Street Journal.

Continued weakness in the global economy and the inability to conclude a trade agreement with China that protects U.S. interests may inject volatility into short-term trading. But a more flexible Fed and continued economic and profit growth created tailwinds for stocks last month.