House Price Explosion

The pandemic has created long-lasting distortions in the economy. Fiscal stimulus checks and generous jobless benefits have left many folks with extra cash. We have seen that play out in strong sales for home improvement and autos.

While distancing restrictions that had been in place have the travel industry, that may change amid pent-up demand and falling Covid cases. A shortage of rental cars has sent prices into the stratosphere in some locales.

One industry that has been met with unexpected demand is housing. Surging sales and the lack of supply have created bidding wars around the nation.

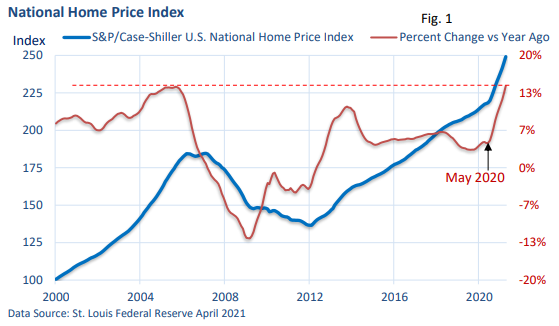

According to the National Home Price Index, prices are at a record level (blue line)—Figure 1. In addition, the acceleration in prices, which began in the middle of 2020, is up at the fastest pace on record (red line). The survey began in 1987.

In another survey, the National Association of Realtors said that the median price of an existing home hit a record $350,300 in May, up 23.6% from May 2020. The median price of a new home in May is up 18% versus one year ago to a record $374,400, according to the U.S. Census.

Yet, as any realtor will tell you, the three most important things in real estate are location, location, location. What is happening in one neighborhood may not be mirrored in another, but nationally prices have soared amid a shortage of inventory.

Making sense out of the madness

Rising prices can’t be pinned on one thing. There is plenty going on including:

- Mortgage rates fell to record lows. The 30-year fixed mortgage fell below 3% last July, according to Freddie Mac’s weekly survey. It held below 3% until March and has hovered near that mark since

- The pandemic discouraged potential buyers from listing homes last year. As a result, inventories fell sharply, limiting choices for buyers at a time low mortgage rates were encouraging fence sitters to start looking.

- New home builders were caught flat-footed by surging demand and have struggled to catch up. Moreover, soaring lumber prices have caused added delays. Notably, the price of lumber fell sharply in June but remains about double the pre-pandemic price (CNBC).

- The Wall Street Journal reported in April that the pandemic set in motion a furious scramble to buy vacation homes. In January 2020, 9% of mortgage applications came from investors and those wanting a second home. That rose to 14% last February.

- On a related note, investors chasing yield have snapped up houses, renting them and nibbling away at supply. These investors aren’t simply mom and pop landlords. The Wall Street Journal said pension funds are also buying homes they plan to rent.

- Mortgage forbearance has helped keep people in their home, preventing a flood of foreclosures.

- Potential sellers who want to move fear a quick house sale could leave them without a home to buy; therefore, they choose to stay put, further limiting the supply of houses.

Still, unlike the bubble during the 2000s, we aren’t seeing a building boom with large numbers of speculators chasing up prices. Just the opposite, there are not enough homes to satisfy demand.

Moody’s Analytics noted last month, “Stress lines are developing as… house prices have substantially outstripped household incomes, effective rents, and construction costs.”

But Moody’s added, “A bubble develops when there is speculation, or when buyers are purchasing homes with the intent of selling quickly for a profit. This isn’t what is happening in today’s housing market,” as house flipping remains low.

Nonetheless, the bubble question is tough to answer simply because forecasting the future involves inputting unknown future variables into an imperfect forecasting model.

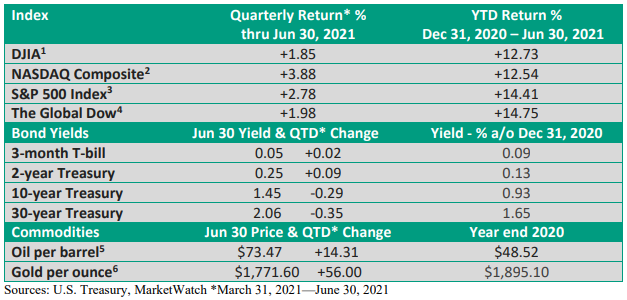

The table of returns highlights the major market averages added to gains in Q2, as strong economic growth, strong profit growth, low interest rates, Fed bond buys, falling daily Covid cases, and the reopening of the economy aid stocks.

Notably, long-term Treasury yields fell in Q2, which suggests that investors may be accepting the Fed’s line that the recent burst in inflation is temporary. It could also suggest that economic growth is set to peak in Q2, as fiscal stimulus wanes.