MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

A Cool Wind Greets October

Last month’s update began with the headline, Strong Economic Fundamentals Drives Shares to New Highs. While I acknowledged that October has a ghoulish reputation, September is, on average, the weakest month for stocks (MarketWatch – Dow Jones Industrial going back to 1896).

This year, October, which historically sports a gain (St. Louis Fed data back to 1970), lived up to its supposedly undeserved reputation.

Let’s dive in and dissect October’s weakness, review the near-term outlook, and put October’s pullback in perspective.

Behind the decline

There wasn’t a specific catalyst that sparked the selloff but there were factors that influenced sentiment.

- Interest rates and a Fed policy mistake. Eight rate hikes by the Fed since December 2015 didn’t cause much concern until we entered October. Are investors getting anxious about an overshoot on rates that could put the brakes on economic growth? It’s not unusual for the cost of money to rise when the economy is expanding, and a growing economy is supportive of corporate profits.

The Fed has yet to signal it may ease up on plans to gradually hike the fed funds rate. Expect one more 0.25 percentage-point increase in December. The Fed has penciled in three such hikes in 2019.

- China, slower global growth, and tariffs. This may be the biggest reason why we’re seeing the latest round of volatility. For firms that conduct a substantial amount of business overseas, we may see a moderation in earnings growth in Q4 and next year.

And tariffs, which weren’t bothering investors a few weeks ago, have taken center stage. Fear—it will further slow economic growth among some industrial names and boost inflation at home.

While Q3 earnings growth has been very strong – up over 26% per Thomson Reuters (estimate through Nov 1), various firms have commented that they are concerned about the impact of U.S. trade policy. Further, earnings growth is expected to moderate in 2019.

The cut in the corporate tax rate is aiding results today. But let’s not discount U.S. economic growth. How the U.S. economy performs next year will play a key role in earnings.

- A U.S. economic slowdown? While U.S. GDP expanded at an annual rate of 3.5% in Q3 (preliminary data from the U.S. BEA), there was one notable soft spot – weakness in business spending.

Weakness in capital spending may be just a one-time slowdown, and consumer spending remains strong. Moreover, job growth and the gradual acceleration in wage gains are set to support consumer outlays.

The Fed’s Beige Book, which is an anecdotal review of the economic data, isn’t suggesting a near-term slowdown, and the Conference Board’s Leading Index hit another high in September.

While housing has stalled—an important leading indicator—and auto sales have moderated, odds of a near-term recession, which would likely send shares into bear market territory, remain low.

Taking the stairs up and the elevator lower

Stocks seems to take the stairs higher and the elevator lower. While we recognize that stocks don’t move up in a straight line, steep declines can sometimes be unnerving.

But trying to time the market and avoid surprises, well, it’s not a realistic option.

Benjamin Graham is not a household name, but he is well-recognized in the investment community. Best known as a mentor to Warren Buffett, he authored “Security Analysis” and “The Intelligent Investor,” two titles that influence financial planning today.

In the 1970s, he said, “If I have noticed anything over these sixty years on Wall Street, it is that people do not succeed in forecasting what’s going to happen to the stock market.” Agreed. Besides, a market timer must be successful twice – consistently and correctly forecasting the peak and trough.

While we may look for patterns that might provide insights, i.e., bear markets center around recessions and profit growth underpins longer-term stock market performance, former Fed Chief Ben Bernanke counseled, “These must be used with considerable caution and healthy skepticism.”

Even if a pattern emerges that may suggest a possible market turning point, if one is either early or late, it becomes exceedingly difficult to outperform the longer-term investment plan.

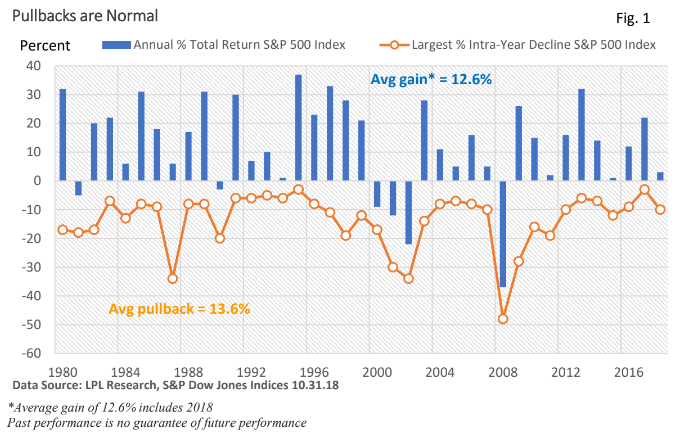

With that in mind, note in Figure 1 that market pullbacks are quite common. And so are annual advances.

The average intra-year decline in the S&P 500 Index since 1980 has been almost 14%. Yet, the total return on the S&P 500 Index, including dividends, averaged a healthy 12.6% annually since 1980. Moreover, we’ve only experienced six full-year declines.

This year the largest intra-year decline is 10%. That occurred in February. We came close to 10% last month. While the swiftness in October’s selloff may be disquieting, recent weakness isn’t out of the ordinary.

We’ve seen risks push their way onto the stage before. When anxieties failed to materially impact the economic outlook, stocks recovered. Stay tuned.