MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

Never Bet Against America

2020 tested America like no other year. It was as if the perfect storm made landfall and washed across the continent. The Covid pandemic, the shutdown of the economy, a presidential election, fires and hurricanes, and civil disobedience.

Yet, as the economy was near the bottom, investment legend Warren Buffett reiterated, “Never bet against America.” We won’t forget this year, but optimism is embedded in our DNA.

Let’s quickly look at some stats. The shuttering of the economy early in the year led to the steepest quarterly decline in U.S. Gross Domestic Product (GDP) on record, according to the U.S. BEA. Economic growth in the following quarter rebounded at the fastest pace on record.

Despite a vicious market selloff in March, stocks recovered and set new highs.

“For Many Big Businesses, 2020 Was a Surprisingly Good Year,” so said a December 18th story in the Wall Street Journal. We see it reflected in equities.

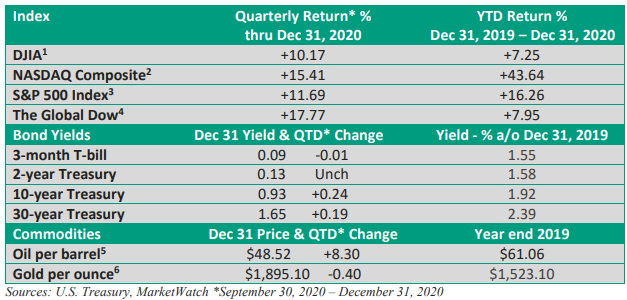

Figure 1 highlights the steep selloff in March, followed by the subsequent rally.

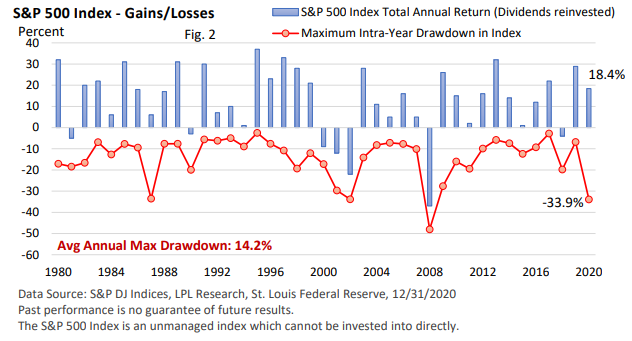

We counsel that market pullbacks are a natural part of the investing landscape, though we acknowledge that the 33.9% peak-to-trough decline in the S&P 500 occurred in only one month.

Yet, let’s take a moment to review Figure 2. Figure 2 highlights the annual return for the S&P 500 Index, including dividends, and the maximum pullback during each year.

Since 1980, the average annual intra-year pullback in the S&P 500 has been 14.2%; yet, the S&P 500 has averaged a 13% advance each year (including dividends).

Here are some additional data points. From 1980 to 2020 (41 years), there have been:

• 7 down years, with the average decline during a down year of -13.1%

• 34 up years, with the average increase during an up year of +18.4%

The only time we’ve had back-to-back declines was 2000-2002 (stock bubble bursting).

• 21 out of 41 years, we’ve had pullbacks of 10% or more, or an average of every 1.95 years.

• 6 of the 41 years saw pullbacks of 20% or more, or an average of every 6.83 years.

Figure 2 illustrates the long-term upward bias in stocks.

Changes in sentiment can force stocks lower over shorter periods, but favorable economic fundamentals have helped fuel longer-term gains.

A review

The economic shutdown triggered the first bear market since the 2008 financial crisis. But there were two important catalysts that helped fuel the subsequent rally.

First, the Federal Reserve went far beyond measures announced during 2008. Second, Congress passed the $2 trillion CARES Act, which provided generous benefits for the unemployed, while aiding households, and small and larger businesses.

The CARES Act and the Fed couldn’t prevent the worst quarterly decline in GDP we’ve ever experienced, but it helped set the stage for a sharp economic rebound in Q3.

Record low interest rates, coupled with economic growth, played a big role in the market’s rally.

Still, the pandemic created distortions in behavior. Technology performed admirably, and you see it reflected in the outperformance of the tech-heavy Nasdaq.

Autos, home improvement, online retailers, streaming services, housing, and big box retailers deemed to be essential did very well during the pandemic.

However, oil and gas, mom and pop outfits, and traditional department stores suffered.

The same could be said of businesses that rely on person-to-person interactions, including movie theaters, sporting events, restaurants, concerts, air travel, and hotels.

It has been the tale of two economies

A Look Ahead

While cautious optimism prevails, the path of the economy is likely to depend on the course of the virus. The likelihood that vaccines will be widely available by June could provide a significant boost to sectors hit hard by social distancing. But distribution of the vaccines must accelerate soon.

Just as investors sniffed out the robust Q3 economic recovery, record highs in December suggest we’ll see further improvement next year, though expect the recovery to be uneven.

Of course, there are always risks.

The Fed is unlikely to lift short-term rates in the new year. But could investors be too complacent regarding bond yields, which many believe are expected to remain low in 2021?

Could inflation unexpectedly rise amid the heavy injections of fiscal stimulus and cash into the economy? And when stocks are priced for perfection, unexpected bad news can create volatility.

Investor’s corner

That said, we can and should acknowledge there are unknowns beyond our control.

Therefore, control what you can control. You can’t control the stock market, and timing the market isn’t a realistic tool. But the one variable you can control is your financial plan.

Among other factors, your plan should consider your time horizon, risk tolerance, and financial goals.

Investors with a long-term time horizon that adhere to a holistic financial plan, which takes multiple economic and market cycles into account, are on the best path to wealth creation and their financial goals.

Finally, I want to wish you a Happy and Prosperous New Year!

I am thankful and humbled that you have chosen me to be your financial advisor, and I look forward to serving you in 2021! Always remember, we are here to assist you, and we are always as close as phone call or email.