MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

Looking for the Ray of Light at the End of a Dark Tunnel

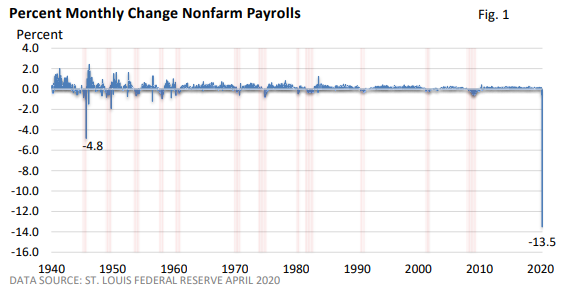

Businesses shed 20.5 million jobs in April. It was the largest number of job losses since monthly records began in 1939 according to the St. Louis Federal Reserve.

Figure 1 offers another vantage point – the percentage change versus the prior month. April’s 13.5% decline in nonfarm payrolls easily surpassed the 4.8% drop at the end of WWII.

While weekly first-time claims for unemployment insurance are slowing, they continue to exceed levels seen in every prior recession (Dept. of Labor).

In April, the unemployment rate surged to a post-depression high of 14.7% (U.S. BLS). Some analysts believe it could surpass 20% in May (Econoday).

Government enforced lockdowns designed to slow the spread of COVID-19 and “flatten the curve” have put tens of millions of people out of work. Beyond that, falling demand for most goods and services has spurred additional layoffs.

But we may be seeing some signs that the economy is starting to stabilize. Over the last 10 weeks, 40 million people have filed a claim for unemployment insurance (Dept of Labor through the week ended May 23).

Those who must continue to file to receive jobless benefits fell 3.9 million to 21 million in the week ended May 16 (data on continuing claims are one week behind), which suggests state reopenings are encouraging businesses to bring back furloughed workers.

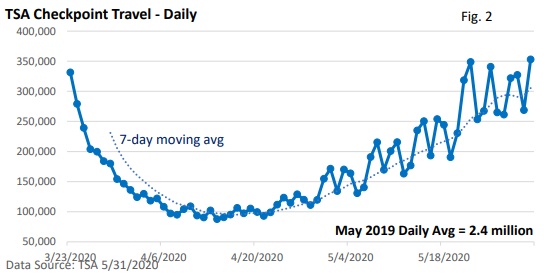

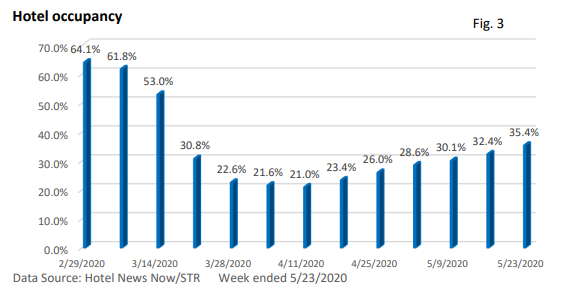

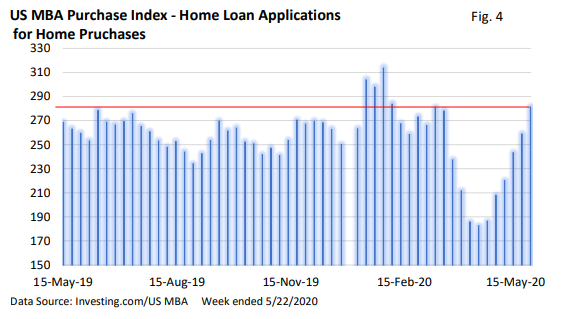

High frequency data offers up hopeful signs, too. While unconventional, weekly and even daily data points suggest the economy is trying to bottom. We won’t quickly return to pre-COVID-19 employment levels, but early indications are cautiously encouraging.

Daily travel through TSA checkpoints is rising again – see Figure 2.

Hotel occupancy is ticking higher as lockdowns ease and leisure travel slowly rises (Figure 3).

The US MBA Purchase Index, which measures home loan applications, has risen for 6-straight weeks and had its fifth-best reading over the last 12 months (Figure 4). It suggests that housing sales are recovering at a faster pace than had been anticipated.

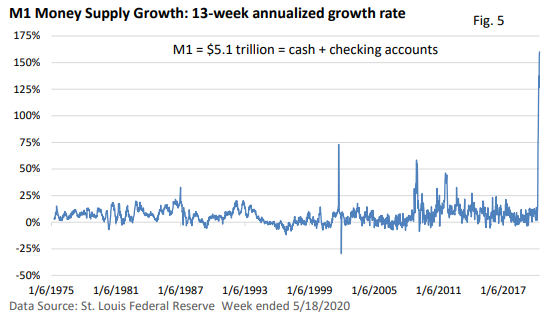

If we’re looking for a tangible sign that any economic recovery may be more robust than many expect, look no further than the money supply. Thanks to the trillions of dollars spent by the government and the massive monetary response from the Federal Reserve, money supply growth has soared beyond anything we’ve ever seen (Figure 5).

However, what might be called the transmission mechanism has been broken via lockdowns and shelter-in-place orders. The money is there, it just can’t be spent right now. But economies are slowly reopening around the country.

Where might we be headed?

Even in the best of times, economic forecasting can be difficult. Today, the outlook is clouded with a much greater degree of uncertainty.

Will the virus lay down over the summer? How will reopenings proceed? How quickly can a vaccine or effective treatment be developed that’s readily available? What might happen to COVID-19 next fall and winter? How quickly will consumers venture back in public and resume prior spending patterns? All are difficult to answer but will help determine the path and speed of an economic recovery.

Final thoughts

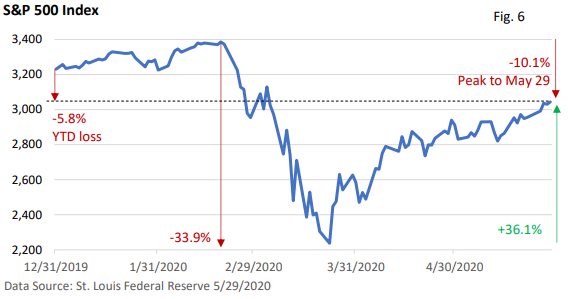

Given the severity of the downturn, the stock market has been incredibly resilient.

The S&P 500 Index is down just 5.8% year-to-date and down just 10.1% from its February 19 peak. The unprecedented response by the Federal Reserve has lent support and so has the $2.9 trillion in fiscal relief from the federal government.

More recently, talk of a vaccine and state reopenings have aided stocks against the backdrop of rock-bottom interest rates.

Analysts are divided as to how quickly the economy may recover, and the questions posed above may be used as a guide.

Though the outlook remains unusually uncertainty, investors collectively look to the future, and they are betting on a rebound later in the summer.