Financial Earthquake

What causes a bank to fail? The short answer is a loan portfolio stuffed with bad loans. In most cases, banking regulators close banks they view as insolvent before a bank run.

But that was prior to Silicon Valley Bank’s (SVB) failure. What happened?

SVB focused on wealthy venture capital clients. As funding for ventures began to dry up, bank customers drew down their balances.

SVB wasn’t saddled with bad loans. Instead, its portfolio of assets was concentrated in supersafe, longer-term Treasury bonds. So far so good, until the surge in interest rates pushed bond prices lower. Bond yields and bond prices move in the opposite direction.

The bank wasn’t subject to much credit risk. Instead, it was exposed to interest rate risk. It’s not fatal, as long as the bank holds the bonds to maturity. But with deposits being drawn down by its customer base, SVB revealed late Wednesday, March 8, that it had sold $21 billion in bonds to free up cash, taking an after-tax loss of $1.8 billion.

It also announced a plan to raise capital and shore up its balance sheet. But the next day, the stock tanked, plans to raise capital were scuttled, and deposits that were above the FDICinsured limit began to flee the bank.

Welcome to the digital age

Depositors weren’t lined up at SVB branches. It was a bank run via smartphones, which was exacerbated by customers that announced intentions via social media. The panic that ensued forced regulators to close the bank Friday morning, March 10.

In less than 48 hours, a bank that had a concentrated position in super-safe Treasury bonds was no longer.

One more failure

Signature Bank, which was heavy in the cryptocurrency space, was closed on Sunday. Without buyers for both banks, the FDIC made a ‘systemic exception,’ guaranteeing all bank deposits at the two banks.

A systemic event is typically defined as an event that risks serious consequences to the financial system and spills over to the rest of the economy. Lehman’s failure in 2008 was a systemic event, as it sparked the financial crisis.

As controversial as it was, Treasury and Federal Reserve officials feared massive bank runs could take place Monday morning, as worried depositors might flee to the “too-big-to-fail” banks or into Treasury notes and bonds.

In addition to full FDIC coverage, the Fed announced a new program that will allow banks to borrow at the maturity (par) value of high-quality bonds.

That way, if the need arises, banks would no longer be forced to sell their bonds at a loss. Swift action to ring-fence the failed banks has not fully restored confidence in the financial system, but it has calmed frayed nerves, and there has been no contagion so far.

Customer cash accounts above the FDIC limit of $250,000 aren’t new. But following the events of recent days, it has created new anxieties, even if they turn out to be temporary.

Fallout

Today’s problems are not comparable to 2008 when poorly underwritten home loans threatened to blow up the financial system.

SVB’s failure was tied to high-quality Treasury bonds that fell in value because of rising interest rates. Regulators will pour over the details, but the finger-pointing has already begun.

Meanwhile, the Federal Reserve was probably on track to lift the fed funds rate by a half percentage point to 5.00 – 5.25% at its late-March meeting. That was before the crisis.

They opted for a quarter percent. The message: we still want to fight inflation (or at least give that appearance), but we are focused on the banks and financial stability.

Currently, the Fed is trying to thread a very tiny needle, focusing on two conflicting goals: raise rates to fight inflation, which could add unwanted stress on banks. Or, abandon its inflation fight (at least for now), and shore up the financial system.

The crisis might do the Fed’s job for it. You see, lending standards were already tightening. The events of recent days could cause additional hurdles for consumers and businesses looking for loans, which would slow the economy down and aid in the fight against inflation.

How much of a slowdown or is a recession inevitable? No one knows.

In recent days, sentiment has shifted on rates, but sentiment on rates is ever-changing, as we’ve seen this year. How the Fed responds in the coming months will depend on how the economic outlook unfolds.

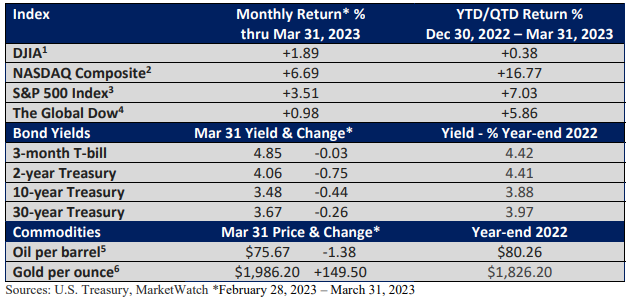

In a nutshell, inflation hasn’t been squashed, but problems with SVB have not spread to other banks. The crisis has waned. We aren’t seeing contagion among weaker banks, which helped stocks rally in recent days, and the first quarter ended on a favorable note