March’s Lion Gives Way to April’s Lamb

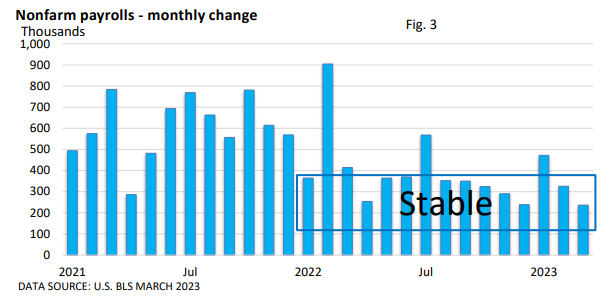

Attention last month shifted away from March’s banking crisis, as investors turned their focus back toward the Federal Reserve and the economy.

First Republic Bank (FRC) was still on shaky ground, reporting it lost a significant percentage of its deposits during the first quarter, according to its Q’1 press release.

On May 1(Today), JPMorgan Chase (JPM) announced it will acquire all of FRC’s deposits and a substantial majority of its assets.

Coupled with measures taken by the Fed and other government agencies in March, investor anxieties seem to have calmed down a bit.

This isn’t 2008 when lenders were too willing to make home loans to just about anybody who wanted one. Today, the regional banks that failed held high-quality assets but made a bad bet on interest rates.

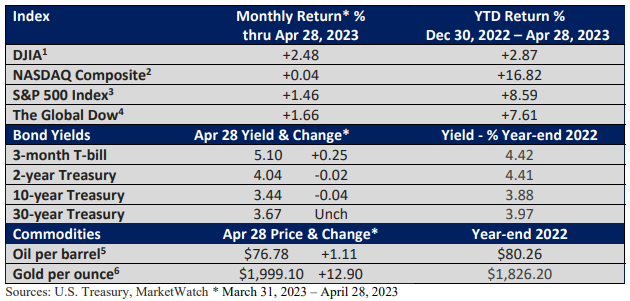

With a relative degree of stability in the banking system, the Fed, which hiked the fed funds rate by 25 basis points (bp, 1 bp = 0.01%) in March, appears set to hike at its early May meeting by another 25 bp to a range of 5.00—5.25% (Figure 1).

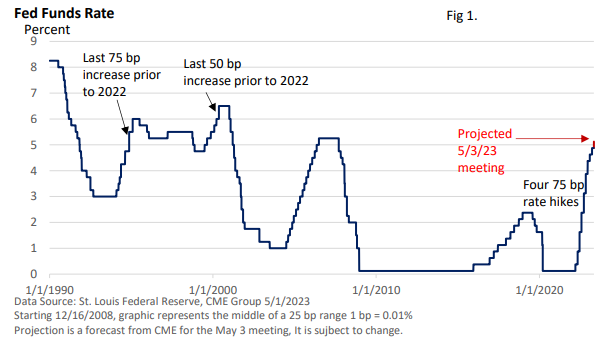

Despite the Fed’s aggressive path, even at 5.125%, the fed funds rate adjusted for inflation is near or slightly below zero, depending on how one measures inflation (Figure 2). During ‘more normal’ times, that would encourage economic growth.

Think about it. Why not take out a loan that can be paid back in cheaper dollars? But it would be difficult to contend that today’s economy is ‘normal.’ The Conference Board’s Leading Economic Index has fallen for 12 straight months.

The rate of contraction accelerated in the last six months, according to the Conference Board, suggesting that a recession this year seems likely.

Moreover, the Fed’s Beige Book, which is a compilation of anecdotal evidence from around the nation, noted that bank lending standards, which were already getting tougher over the last year, tightened further following Silicon Valley Bank’s failure.

Why does this matter? Increased difficulty in obtaining loans can throttle consumer and business spending.

It’s one reason why investors currently believe that May might be the Fed’s last rate increase.

Or, at a minimum, it may pause and survey the economic landscape before making any other decisions.

It would be a shift for the Fed, which was quite resolute last year in its determination to get inflation back to its 2% annual goal. Fed Chief Powell had said he wanted “clear evidence that inflation is moving back down to 2 percent” before ending rate hikes.

Inflation has moderated, but it’s difficult to assert that inflation is returning to 2% right now. A big slowdown in the CPI is simply the result of falling oil prices—see Figure 2. As many are aware, oil can give, but it can also take away.

Has the Fed moved the goalpost? We may get a clearer picture following the early May meeting.

Job growth

It’s not all doom and gloom. Stocks have rallied since the start of the year, and bond yields are off their highs.

Gross Domestic Product (GDP), which is the largest measure of the value of goods and services, expanded at a 1.1% annual pace in the first quarter, per the U.S. Bureau of Economic Analysis (BEA). It missed expectations but remained positive.

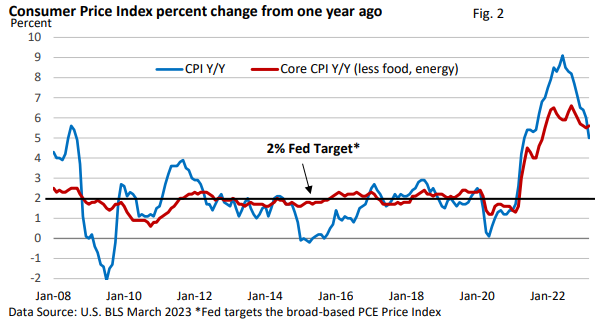

Furthermore, the economy continues to create jobs, despite high-profile layoffs. Job growth has been stable and strong for over a year—see Figure 3.

When it landed outside of the range, it surprised to the upside.

Some of the gains, maybe much of the rise in recent months, may simply be due to the still high level of job openings in some industries, especially in lower-paying service jobs.

Some of the cash from the Covid-related stimulus remains in the bank, which may help support spending in the coming months. Plus, government purchases have grown rapidly in recent quarters, according to the U.S. BEA.

It helps the economy in the short term, as it supports demand for goods and services. But the flip side is an increase in the deficit and added pressure on inflation.

As April ended, investors grappled with conflicting crosscurrents.

On the one hand, rate hikes may soon end. Ultimately, it will depend on inflation and economic growth. On the other hand, a recession would probably increase headwinds for investors.

Major market indexes rose during April, signaling that most investors remain in the no-recession camp.

A so-called ‘no-landing’ scenario (continued economic growth, high inflation) would keep upward pressure on rates.

A ‘soft landing’ (slowing growth, slowing inflation)’ is the best-case scenario. Rate hikes would probably end, and we might even see a cut in rates, and a recession is avoided.

A ‘hard landing (recession, slower inflation)’ can’t be ruled out. It would likely lead to rate cuts, but the cost would be rising unemployment and weak corporate profits.