Market Melt Up

The S&P 500 Index is up 28.3% from its October 2022 low and is 4.3% below its early 2022 alltime closing high, according to S&P 500 data from the St. Louis Fed—data through July 31.

Through May of this year, the S&P 500’s advance was powered by what might be called the ‘magnificent seven:’ Amazon, (AMZN), Tesla (TSLA), Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOGL, formerly Google), and Meta Platforms (META, formerly Facebook).

According to Investopedia, these seven stocks accounted for 26% of the S&P 500 as of July 6.

However, starting in June, sentiment shifted, and the rally broadened considerably.

If we could construct an equal-weighted gauge of all the S&P 500 stocks, i.e., no stock would carry more weight than any other, that gauge of the stock market would have bested the S&P 500 over the last two months leading up to July 31, according to Yahoo Finance.

The ‘magnificent 7’ would make up just 1.4% of the S&P 500 in our equal-weighted gauge.

Tailwinds that aided shares

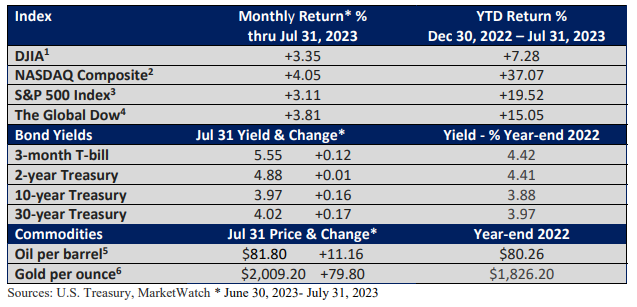

For starters, the heavily forecasted recession has been a no-show so far. In fact, according to the latest data from the U.S. Bureau of Economic Analysis, economic growth accelerated in the second quarter.

Gross Domestic Product (GDP), which is the broadest measure of economic activity, increased at an annual pace of 2.4% in the second quarter, up from 2.0% in Q1 (Figure 1).

And we can’t cite one-off factors that sometimes distort the headline number. While consumer spending eased in the second quarter, business spending more than picked up any slack. Overall, it was a very balanced number.

Why does economic growth support stocks? There isn’t a direct one-to-one correlation between GDP growth and equities. But GDP growth supports corporate profits. Longer-term profit growth is an important factor in stock market performance.

According to Refintiv, Q2 profit reports are exceeding a low hurdle, and while the season isn’t complete, the upbeat start has aided shares.

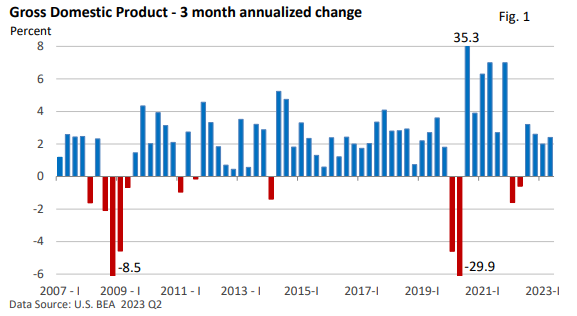

Finally, no update on market performance would be complete without a review of interest rates.

While 2022’s steep rise in interest rates was engineered by the Federal Reserve to address the sharp rise in inflation, it also led to last year’s bear market.

Today, inflation is moderating, and central bankers no longer feel the need to be as forceful.

Figure 2 illustrates the pace of rate hikes since March 2022. Note that the seventh meeting in the cycle (December 2022) was the last increase greater than 25 basis points (bp, 1 bp = 0.01%).

At the end of July, the Federal Reserve increased the fed funds rate by 25 bp to 5.25-5.50%, the highest level in 22 years (meeting 12 in Figure 2). Fed Chief Jerome Powell left the door open to at least one more rate increase. He refrained from any talk about a rate cut this year.

While the fed funds rate is up since the start of the year, the more muted pace, coupled with an expanding economy and a moderation in inflation, have been tailwinds for stocks.

Compare and contrast to this time a year ago when interest rates were soaring, inflation was showing no signs of slowing, and recession worries were on the rise.

Naturally, every trend carries some degree of risk. Geopolitical threats are always present, economic growth may stall, or the current decline in the rate of inflation could be short-lived.

Final thoughts

How did you react to last year’s selloff? Some folks took it in stride, recognizing that stocks rise longer term, but shorter-term setbacks are inevitable.

Others may have found it unsettling, as the appetite for taking on added risk is tested during market declines. If so, it might be time to revisit your strategy.

No matter how you are positioned, successful long-term investors recognize that a disciplined approach has historically been the shortest path to reaching one’s financial objectives.