Late Summer Doldrums

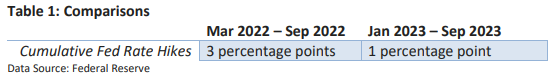

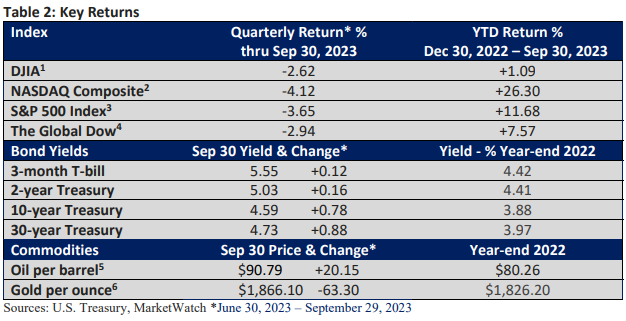

Stocks have had a strong run this year. A much slower pace of rate hikes, as illustrated in Table 1, a belief (or hope) that the Federal Reserve would stop hiking interest rates and eventually start cutting them, and the absence of a much-forecasted recession.

The rally that began last October for the S&P 500 continued into the third quarter, with the S&P 500 Index peaking at the end of July. It has since fallen a modest 6.6% through the end of September, according to S&P 500 data provided by the St. Louis Federal Reserve.

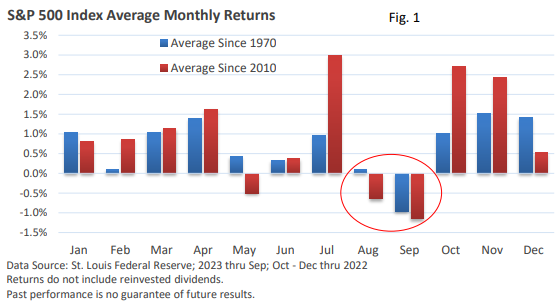

As discussed last month, August and September have historically underperformed—see Figure 1. The prior two months did not merit exceptions.

While July closed on a high note, the losses incurred in August and September wiped out the early gains made in Q3.

Investors are attempting to price in what analysts call “higher for longer.” Higher refers to interest rates. Longer refers to how long rates might stay higher before any possible rate cut or cuts.

All else equal, higher interest rates create stiffer headwinds for equities because higher rates compete for investor dollars.

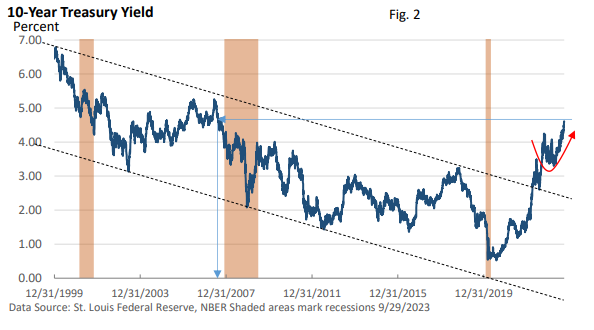

Notably, Treasury yields have turned higher, as Figure 2 illustrates.

Throughout the remainder of the year, the Treasury will be required to borrow a significant amount of money. As a result of an increase in the supply of bonds, yields may rise to attract buyers of the new bonds that will be issued.

Moreover, the Federal Reserve surprised many by adopting a more aggressive tone than anticipated at its September meeting.

It’s hard to forecast the future

The Federal Reserve releases its forecasts for GDP, inflation, and unemployment every quarter: December, March, June, and September.

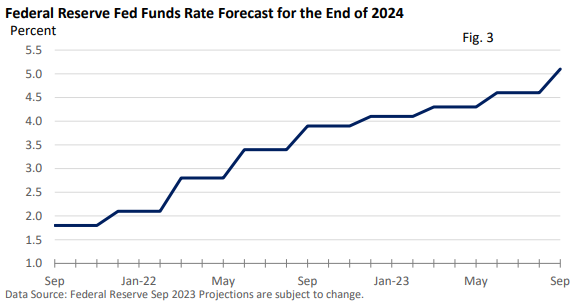

The Fed maintained the fed funds rate at 5.25 – 5.50% in September, but it hinted at another rate hike this year and raised its year-end 2024 estimate of the fed funds rate from 4.6% to 5.1% (Figure 3).

Note that the Fed’s projections in Figure 3 have almost tripled over the last two years as it hopes to rein in stubbornly high inflation. In fact, it has raised its forecast every quarter since September 2021, when it first issued a forecast for year-end 2024.

Two years ago, the Fed expected a 2024 year-end fed funds rate of about 1.8%. At the time, it was calling the burst in inflation “transitory.” Today, its forecast for December 2024 is 5.1%.

The best and brightest minds struggle with accurately forecasting future events because projections rely on developing patterns based on historical data. But patterns may change over time, reducing the effectiveness of these models.

In addition, the influence of different variables on the economy can fluctuate from one economic cycle to another, as each cycle has its own unique characteristics.

For example, rising interest rates raise borrowing costs and should slow consumer and business spending. But economic growth has been surprisingly resilient. As Fed officials are fond of saying, there are “long and variable lags” regarding the impact from changing interest rates.

Final thoughts

As we have emphasized in the past, focus on what you can control. You can’t control the economy or stock market returns, but you can control your investment strategy.

Having a written financial plan is the roadmap to your financial goals. It allows you to track your progress, and it reduces uncertainty. Research shows that a solid plan also supports sound money habits.