MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

Drama on Wall Street

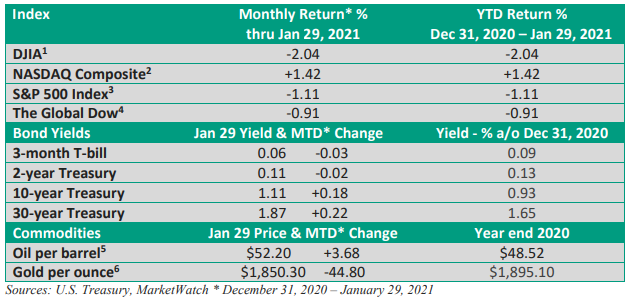

The major market indexes have had a very strong run since bottoming last March. We saw some uncertainty early in the fall heading into the election, but the bitter contest is over. With the announcement of vaccines and new fiscal stimulus, stocks roared to new highs.

Moreover, low interest rates, monthly Federal Reserve bond buys, better-than-expected corporate profits, and a growing economy have added to favorable sentiment.

Yet, euphoria can sometimes breed too much euphoria, which can create conditions that can lead to unexpected volatility.

Revenge of the nerds

Last week, a few stocks that had been heavily shorted by hedge funds (shorting is a risky way to profit if a stock falls in price), soared in price as young speculators used social media chat rooms to encourage purchases and snare professionals in a money-losing trap. It’s a populist and profit motive for these chatroom traders.

The stock that received the most attention was GameStop (GME), a struggling video game retailer that’s been heavily shorted (CNBC, MarketWatch) by the professionals. GameStop was selling below $20 per share in early January but peaked at over $480 on January 28, according to price data from Yahoo Finance. GameStop closed at $325 on January 29.

Why have a few names created volatility? There are fears that hedge funds being squeezed might be forced to sell other stocks and raise cash.

Fed Chief Jerome Powell was asked about market action at last week’s press conference, which followed the first Fed meeting of the year.

Powell declined to comment on specific firms, but opined that recent fiscal policy and vaccines were responsible for market gains since November, not easy Fed policy, i.e., low interest rates.

Low rates and Fed bond buys, economic growth, better-than-expected corporate profits, fiscal stimulus, and the new vaccines have all fueled the rally. Mix in social media, an Internet-driven insurgency, and zero-commission trading, and unexpected volatility surfaced last week.

Volatility can happen for any number of reasons. A 10% market correction can never be ruled out. Still, the economic fundamentals that lifted stocks over the last year remain in place.

How might the drama end?

Most professionals believe it will end when most short sellers have given up and have closed out their positions, or regulators or brokers intervene. At that point, we could see a sharp selloff in GameStop and other companies hyped by the chatroom crowd. But might young traders target new, heavily shorted stocks? Might this turn into a new phenomenon we must adapt to?

Longer term, economic fundamentals and economic activity determine stock prices.

As billionaire investor Leon Cooperman said on CNBC late last month, “At the end of the day, the stock market reflects economic progress or the lack thereof. Water seeks its own level.”

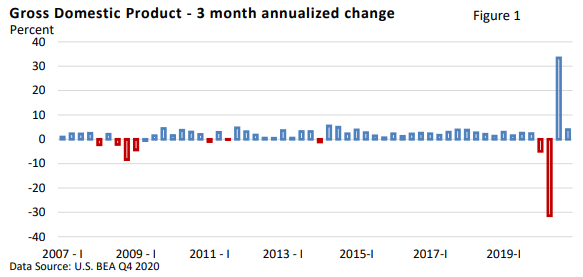

Growth moderates in the fourth quarter

The U.S. BEA reported that Gross Domestic Product, which is the largest measure of economic output, slowed from Q3’s record annualized pace of 33.4% to 4.0% in Q4—see Figure 1.

Historically, 4% is solid, but we saw a significant moderation in consumer spending, as the surge in new U.S. Covid cases late last year played a big role in restricting activity. Business investment and housing, however, helped drive overall growth.

In December, nonfarm payrolls fell by 140,000. This included a loss of 372,000 jobs in the restaurant industry, according to the U.S. Bureau of Labor Statistics.

In other words, one industry more than offset job gains in the rest of the economy.

Various surveys of manufacturing and the broad-based service sector suggest that economic growth sped up in January. In particular, Markit Economics, which surveys the economic landscape, said U.S. manufacturing in January accelerated at its fastest pace since it began publishing its index

Rising Covid cases late last year have hampered overall growth. While new cases have slowed per Johns Hopkins data, they remain elevated. And the risk from new strains is adding to uncertainty.

However, fiscal stimulus is in the pipeline, additional government stimulus is on the table, and a high savings rate seem set to send a mountain of cash into the economy this year.

Ultimately, the rollout and success of the new vaccines will play an important role in driving economic confidence in the months ahead.

One final note on last week’s action: When volatility strikes, even seasoned investors sometimes consider changes to well-diversified financial plans. Over the longer term, relying on timetested investment principles and avoiding decisions based on short-term market gyrations have historically led to the best outcome.

If you have any questions or concerns, feel free to reach out to me. Please stay safe.