MONTHLY FINANCIAL MARKET UPDATE

The summary below is provided for educational purposes only. If you have any thoughts or would like to discuss any other matters, please feel free to contact me.

The Wall Street Main Street Disconnect

The economic data are rolling in. With few exceptions, we don’t have much of a read on April’s numbers, but March has been ugly.

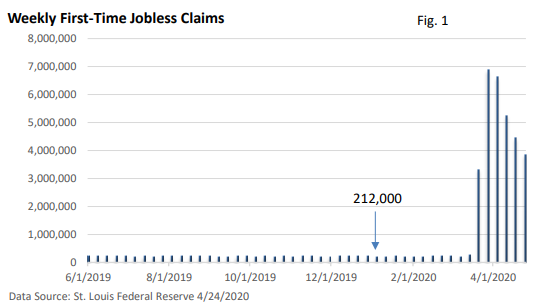

Weekly first-time claims for unemployment insurance have exceeded 30 million in a 6-week period – see Figure 1. It’s disheartening and a number that would have been inconceivable a couple of months ago.

March’s 5.4% decline in industrial production was the biggest one-month drop since the end of World War II (St. Louis Federal Reserve). A 7.5% decline in March consumer spending was the largest ever recorded (dating back to 1959).

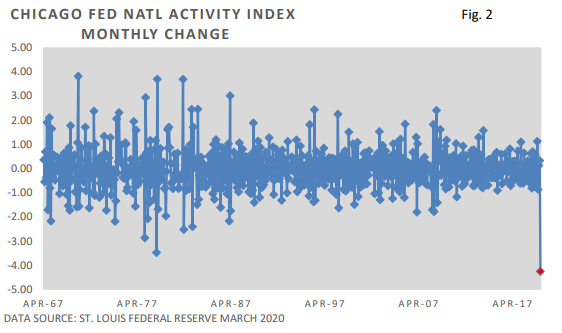

The Chicago Fed National Activity Index is a broad-based measure of economic activity. It is comprised of 85 separate monthly indicators.

In March, it registered its sharpest monthly decline ever – see Figure 2.

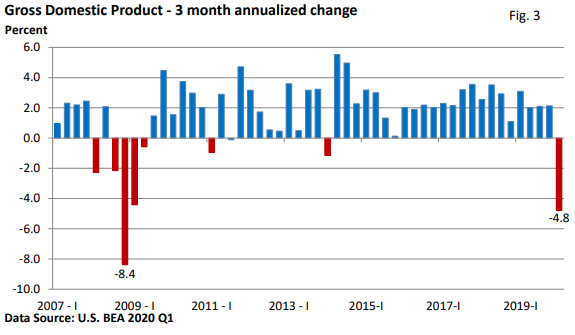

Preliminary Q1 GDP fell at an annualized pace of 4.8% – see Figure 3. The number is subject to revisions. Q2 is expected to be much worse as the full impact of the crisis is reflected in the economic data.

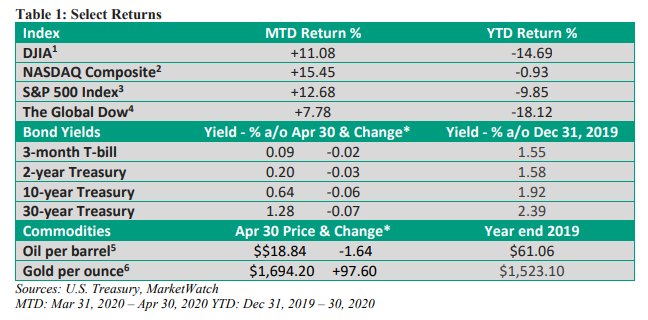

The monthly rally for the Dow and S&P 500 is the best since 1987 and the best April since 1938, according to Dow Jones Market Data.

Let’s explore the primary reasons for April’s rise.

- Don’t fight the Fed is an old Wall Street adage. Economic activity has fallen off a cliff, which suggests stocks should have followed.

Through the near-term bottom of March 23, stocks were in a tailspin, but the Federal Reserve has acted with unprecedented speed.

For example, the Fed began a torrent of bond-buying to stabilize markets. Between March 16 and April 16, the Fed bought nearly $79 billion a day in Treasury and mortgage-backed securities. By comparison, it bought about $85 billion a month between 2012 and 2014 per the Wall Street Journal.

Further, the Fed has not only resurrected credit market programs used in the 2008 financial crisis, it is aggressively reaching out to Main Street.

- The federal government has reacted with uncharacteristic speed, doling out over $2.5 trillion in stimulus checks, jobless benefits, help to small businesses, and more. Some of the programs haven’t worked flawlessly, but the government’s efforts are well above the $787 billion in 2009 stimulus.

Is it too much? Some will fret over the expected explosion in the deficit. However, the response to the economic crisis has had strong bipartisan support.

- Investors are forward-looking and are eyeing 2021. In 2019, S&P 500 profits hit a record $163/share (Refinitiv). While the range of uncertainty is very high and projections are subject to change, profits are forecast to fall to $131/share in 2020 and rise to $168/share in 2021 (as of Apr 30).

$168 may still be too high, and much will depend on how the economic outlook unfolds. Nevertheless, talk of some type of economic recovery later this year and next aids sentiment.

- Finally, the virus appears to be peaking, and investors are cautiously eyeing states that are set to slowly reopen their economies. It’s a delicate task, balancing the need to contain the virus with economic vitality.

- Possible treatments and a COVID-19 vaccine have also soothed nerves.

We can continue to expect stock market volatility in the near term. The economic outlook is uncertain as businesses slowly re-open, but there is talk of more support from the federal government and the Federal Reserve. Given what’s happening in the real economy today, stock market reaction has been cautiously encouraging.

Final thoughts

I don’t want to downplay the havoc created by COVID-19. We are living in a world that nobody could have possibly envisioned a few months ago. You may have friends and loved ones who are dealing with the disease. It’s incredibly unpleasant.

Yet, unexpected blessings have surfaced. People are reaching out to family and friends via texting, Zoom, and emails. Some are even connecting the old-fashioned way – by phone.

Activities and jobs around the country have been suspended but not ended. I am confident we will eventually see an economic recovery take root, and the pandemic will subside.

We are a resilient people. Together we will get through this dark night, and we will be stronger for it.

Stay safe, stay healthy, and please abide by government mandates designed to slow the spread of COVID-19. Remember, my door is always open.