Shifting Fundamentals

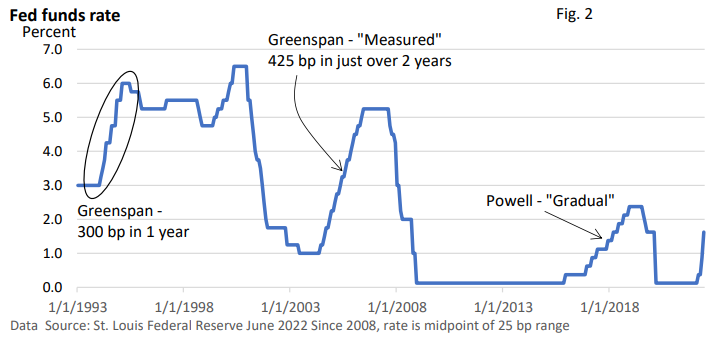

Stocks during the first half of the year turned in their worst performances since 1970, according to CNBC. In part, it’s a timing issue since the broad-based S&P 500 Index peaked just after the year began. But that doesn’t ease the uncertainty that has fueled the decline.

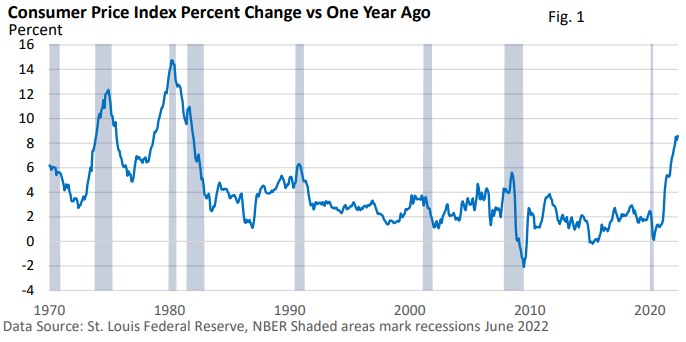

Let’s back up for a moment. During the 2010s, the economic fundamentals were supportive of stocks: modest economic growth, rising corporate profits, low interest rates, and low inflation. When the Federal Reserve began hiking interest rates, the pace was gradual.

Rate hikes were gradual because economic growth wasn’t particularly fast, and inflation wasn’t a problem. In fact, the Fed fretted over its inability to get inflation up to its 2% target. In retrospect, call it a high-class problem.

It’s not that we didn’t see pullbacks. We did. Stocks never move up in a straight line, and corrections, when they occur, come unexpectedly. Nonetheless, favorable economic fundamentals reasserted, and the broad market indexes trended higher over the decade.

Today, the economic fundamentals have shifted.

These include surging inflation, aggressive Fed rate hikes, Russia’s ongoing war and its impact on oil and certain commodities, and recent Covid lockdowns in China—all which are helping raise fears of a recession.

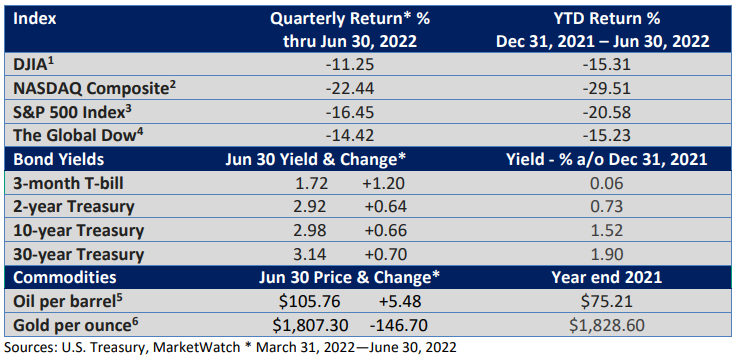

As Figure 1 illustrates, inflation is at a 40-year high, and we have yet to see significant signs that inflation is slowing.

In response to stubbornly high inflation, the Fed shifted away from its super easy money policy last year. Today, it’s talking tough, playing catchup, and forcefully raising interest rates in order to wring inflation out of the system.

In June, the Fed lifted the fed funds rate by 75 basis points (bp, 1 bp =0.01%) to a range of 1.50–1.75%. It was the first 75 bp rate increase since 1994—see Figure 2.

Still, the aggressive path and factors outside its control have reduced the odds the Fed can engineer a soft landing—a slowdown in inflation that doesn’t trigger a recession.

Fed Chief Powell acknowledged near the end of June, “It has gotten harder. The pathways (to avoid a recession) have gotten narrower.” Such uncertainty has pressured stocks since a recession would hamper corporate earnings.

Figure 2 highlights the path of the fed funds rate over the last 30 years. Former Fed Chief Alan Greenspan preemptively raised rates in 1994—300 bp in one year—to stave off inflation.

Though unemployment was high, double-digit inflation of the 1970s and early 1980s was still uppermost on the minds of Fed policymakers.

During the early 2000s, “measured (his word of choice)” rate increases amounted to seventeen 25 bp rate hikes. During the late 2010s, Powell gradually lifted the fed funds rate.

In prior rate-hike cycles, increases were preemptive. Today, the Fed is reacting to high inflation. And the Fed believes another 50 or 75 bp is probably appropriate at its upcoming July meeting.

Note in Figure 1 that inflation peaked and slowed during and after a recession.

Why? Consumer demand falls, which makes it more difficult to raise prices. Additionally, the jobless rate rises, and wage growth slows. Smaller wage increases put less pressure on prices.

However, let’s state the obvious. Triggering a recession to stifle inflation is not ideal.

Today, a recession is a risk but not a foregone conclusion. Some leading economic indicators such as housing sales and consumer confidence have turned lower. But job openings are high, layoffs remain low, job growth is strong, and plenty of stimulus cash remains in the bank.

Perspective

The first half of the year is the worst start since 1970. However, perspective is in order. Since 1957, the S&P 500 Index has averaged a 20% or greater decline over a six-month period roughly every five years, per CNBC.

And there have been five periods when the broad-based index lost more than 30% over six months. In every instance, stocks eventually recovered.

If you have questions or would like to talk, we are only a phone call or email away.